The British pound initially fell rather hard during the trading session on Friday but turned around to recover a bit in order to form a hammer-like candlestick. The British pound had gotten far ahead of itself for some time, and the last couple of days were desperately needed. In fact, the shooting star on Wednesday was your first clue that we were going to have some trouble. The 1.42 level was a major resistance barrier on the weekly chart, so I think it all ties together quite nicely.

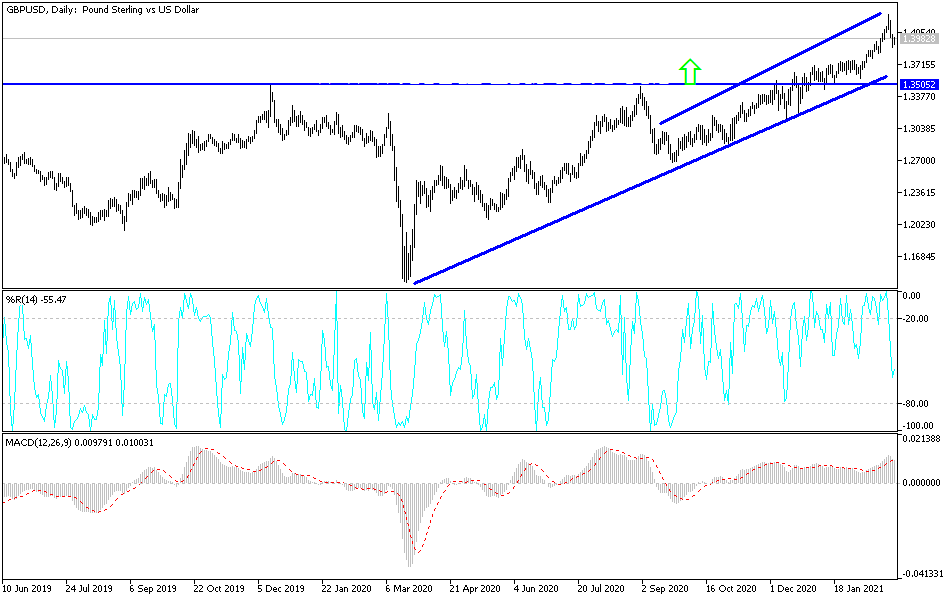

I think sooner or later we will see buyers jump back into this market to take advantage of a pullback, as it has been so relentless in its march higher. The 1.42 level being broken to the upside would be the next leg kicking off to send the British pound towards 1.45 handle, but I do not see that happening quite yet. I think we need to pull back a little bit further, or at least go sideways and dance around the psychologically important 1.40 level. What I do like about the uptrending channel that we are still in is the fact that the uptrend line is backed up by the 50-day EMA just below it and the 1.3750 level which was where we had broken out from a couple of weeks ago. With that in mind, I think that there are plenty of reasons to believe that the British pound will find a bid underneath and continue to grind higher.

This will be especially true as people are paying attention to the vaccination numbers in the United Kingdom outperforming almost everybody else, and at the same time we have seen stimulus in the United States forced through Congress and is not that far away at this point. Granted, it has probably already been priced into the market, but at the end of the day stimulus means that the currency should drop in value over the longer term. All of this together tells me that we should continue to go to the upside and go looking towards 1.45 handle eventually. I have no interest in shorting this market, at least not until we would break down below the 1.35 handle, which is almost 500 points from where we are as I write this.