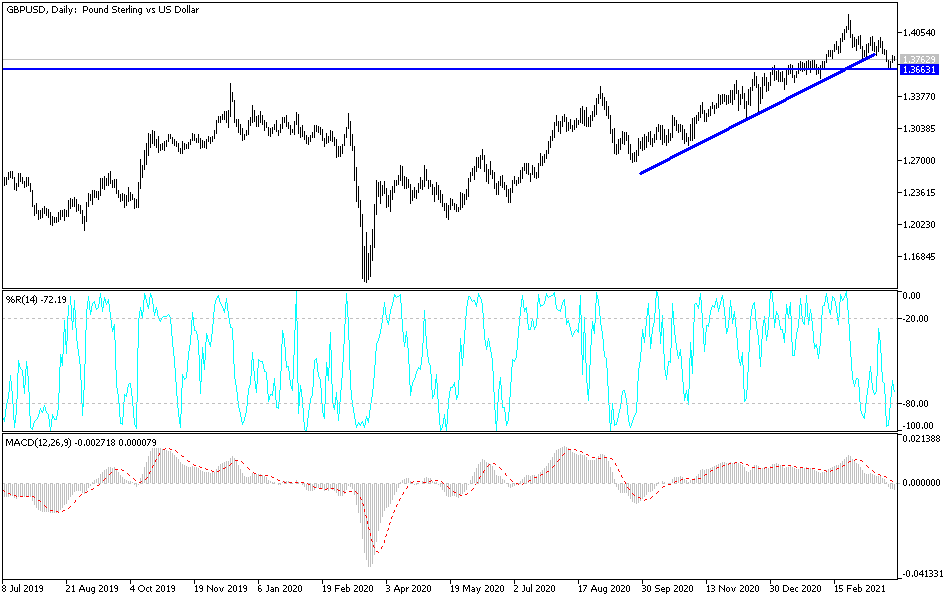

The British pound rallied a bit during the trading session on Friday to overcome the 1.3750 level again. This is an area that has been previous resistance, and therefore it should have been supported. The 1.3750 level is the top of a range that starts at the 1.35 handle, so I think of this more or less as a “spongy region” that could offer support. This is a market that is also supported by the 200-day EMA underneath the 1.35 handle, so I believe that the British pound in general should outperform any other G-10 currencies against the USD.

We had recently broken down below an uptrending channel, but channels come and go, and as a result one still has to look forward towards the potential strength of an economy. The UK economy is primed to do much better than most of its peers, as 25 million Britons have been vaccinated, at least the first half of the two-shot vaccine. Because of this, the British economy should continue to run better than many of the others as we reopen quicker there, but another thing that needs to come into play is that the Brexit situation did not wipe out the United Kingdom like so many people had reported would happen.

This does not mean that we will go straight up in the air from here, and I think the way to look at this chart is that the British pound will be “less bad” against the US dollar than many other currencies. However, if we see some type of softening of the greenback, then it is likely that the British pound will start to go parabolic again. I am either a buyer of the British pound or I am sitting on the sidelines and letting it grind sideways. Currently, it is the latter of the two options that I am taking, because I believe that we still need to try to support and then stabilize the market. If we were to turn around a break above the 1.39 handle, then it is very likely that the market will go looking towards the 1.40 level. Breaking above that level then opens up a retest of that crucial 1.42 handle above. As far as selling is concerned, we would need to break down below the 200-day EMA before I consider doing so. If I want to buy the US dollar, I will buy it against other currencies.