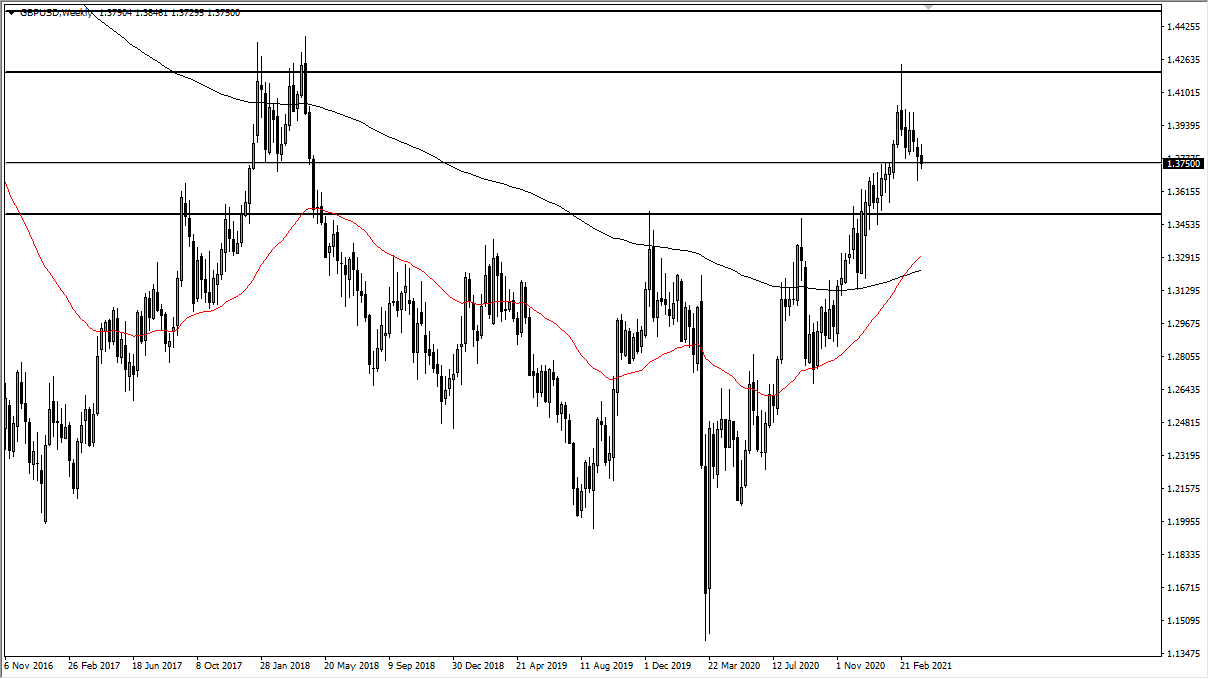

The British pound has been a bit soft during the month of March, but still remains somewhat elevated. When you look at the last couple of weeks, the market has pulled back from elevated levels at the 1.42 level, an area that is massive resistance on longer-term charts. Currently, the market sees support at the 1.3750 level and then underneath there at the 1.35 handle. I anticipate that most of the month of April will probably see choppy volatility, but the longer-term attitude of the market clearly looks as if it wants to go higher.

As of late, we have seen US yields in the 10 year note in other treasuries rally, which of course puts bullish pressure on the US dollar in general. That will be seen over here, but for what it is worth I do think that the 1.35 level will continue to be important as far as support is concerned. If we were to break down below the 1.35 handle, then the market goes looking at the 1.3250 level.

Nonetheless, the British pound should continue to be one of the better performers against the greenback, and therefore the downside is probably a bit more limited here than it is in some of the other markets. After all, the British economy is starting to open up much quicker than some of its peers, and of course some 30 million Britons have been at least partially vaccinated, meaning that we are starting to see traders in the Forex world show signs of divergence when it comes to countries that are on track to give the population vaccinated in those that are struggling.

Because of this, even though the US dollar is going to continue to strengthen through the month, it is probably going to see less strength against the pound. This of course is a relative game, so even though I do believe that we continue to go lower, at least in the first half of the month, I think that the losses in the British pound will be relatively mild, and we will turn around and bounce in the second half of the month to continue the overall reach towards 1.42 above. If that level does get broken, it opens up a move towards the 1.45 level which at this point is still my target for this pair longer term.