For the second day in a row, the EUR/USD is trying to benefit from market optimism stemming from the passage of the US stimulus bill and global vaccinations. The pair stabilized around the level of 1.1924, a reversal from the 1.1835 support level, its lowest in nearly four months. The latest euro gains come on a day when the European Central Bank is set to announce its monetary policy decisions. There are strong expectations that the bank will keep interest rates unchanged, and there is cautious anticipation of the bank's policy statement, which will be issued with the decision along with the statements of the bank’s governor, Christine Lagarde.

Forex investors want to stand by the bank's hints about the euro exchange rate and the slow European vaccination rate, as well as the bank's plans to provide more stimulus to revive the Eurozone economy, which is still facing deflation due to the COVID-19 pandemic.

US Congress has sent President Joe Biden a $1.9 trillion relief bill to counter the effects of COVID-19. Most noticeable to many Americans are provisions to provide up to $1,400 in direct payments this year for most adults and extend emergency unemployment benefits of $300 per week through early September.

This includes hundreds of billions for COVID-19 vaccines and treatments, schools, state and local governments, and struggling industries from airlines to concert halls.

There are expanded tax credits over the next year for children, childcare and family leave, as well as spending on renters, nutrition programs, and utility bills. There is help for farmers, pension schemes and student borrowers, subsidies for consumers who buy health insurance and Medicaid coverage for low-income people.

Spanish health authorities will tighten restrictions during the upcoming Easter week in an effort to prevent another spike in coronavirus infections. In this regard, Health Minister Carolina Darias said that between March 26 and April 9, travel between regions of the Spanish peninsula will be banned. Meetings will be limited to four people in closed spaces and six people in open spaces, and the night curfew already in place should begin by 11:00 PM.

These same restrictions will apply to seven regions, including central Madrid, from March 17-21, during the San Jose Festival. Renewed cases in Spain decreased for 14 days per 100,000 residents to 139 cases on Wednesday. Spain has confirmed 71,727 deaths from the virus.

The German government has said that it expects the supply of coronavirus vaccines to rise steadily next month, reaching a peak of around 10 million doses per week in July. Accordingly, Spokesman Stephen Seibert says that the models used by the government indicate that the weekly supply could reach nearly 5 million by the end of April. The German vaccine campaign was delayed for countries such as Britain and the United States.

By Wednesday, about 5.6 million people in Germany had received at least a first dose of the vaccine, compared to 22.6 million in Britain. For her part, Chancellor Angela Merkel has pledged to offer a vaccine to all Germans before the national elections on 26 September.

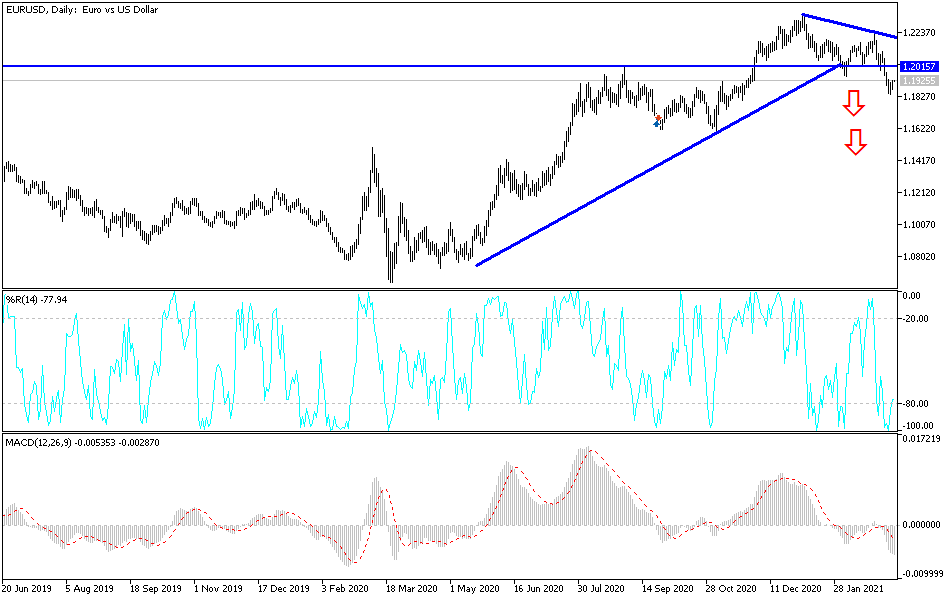

Technical analysis of the pair:

The EUR/USD is still facing bearish momentum as long as it remains below the support level of 1.1900, and despite the technical indicators reaching strong oversold areas, the pair lacks sufficient momentum to exit its recently formed bearish channel. The bulls will not regain control without breaching the resistance level at 1.2200. The closest support currently for the pair are 1.1880 and 1.1790, which are optimal levels at which to buy and wait for a rebound higher.

Today's economic calendar:

The euro will be greatly affected by the European Central Bank’s announcement of its monetary policy decisions and the statements of ECB Governor Lagarde. From the USA, all the focus will be on announcing the number of weekly jobless claims.