The EUR/USD pair has been in a downward correction that pushed it towards the support level of 1.1882 before settling around 1.1906, in an attempt to benefit from disappointing US retail sales numbers. The US Federal Reserve will announce its monetary policy decisions today, followed by important upcoming statements from Chairman Jerome Powell. Markets want to hear the reaction of the monetary policy officials of the largest central bank in the world about what happened in the bond market and the inflation concerns that dominated investor expectations.

The EU's drug regulator insisted that there was "no indication" that the AstraZeneca vaccine was causing blood clots as governments around the world faced the dilemma of advancing a vaccine known to save lives or suspend its use due to reports of blood clots in some of the recipients. Accordingly, the European Medicines Agency urged governments not to stop using the vaccine at a time when the epidemic is still claiming thousands of lives every day. There are already concerns that the brief suspension could have disastrous effects on confidence in vaccination campaigns around the world, many of which are already struggling to overcome logistical hurdles and widespread hesitation about vaccines.

The US Retail Group's February numbers missed the expected change of -0.9% with a larger negative change of -3.5%. General retail sales for this period also missed the expected change (monthly) of -0.5% with a change of -3%. Excluding auto retail sales missed the expected change (monthly) of -0.1% with a change of -2.7%. Industrial production for February also missed the expected change (monthly) of 0.6% with a reading of -2.2%, while production capacity utilization came in below 75.8% with a record of 73.8%. On the other hand, the Import Price Index outperformed the expected change (monthly) by 1.2% with a record 1.3%. February's Export Price Index beat expectations by 0.9% with 1.6% being monitored on a monthly basis. The NAHB Housing Market Index for March came in below 83 with 82.

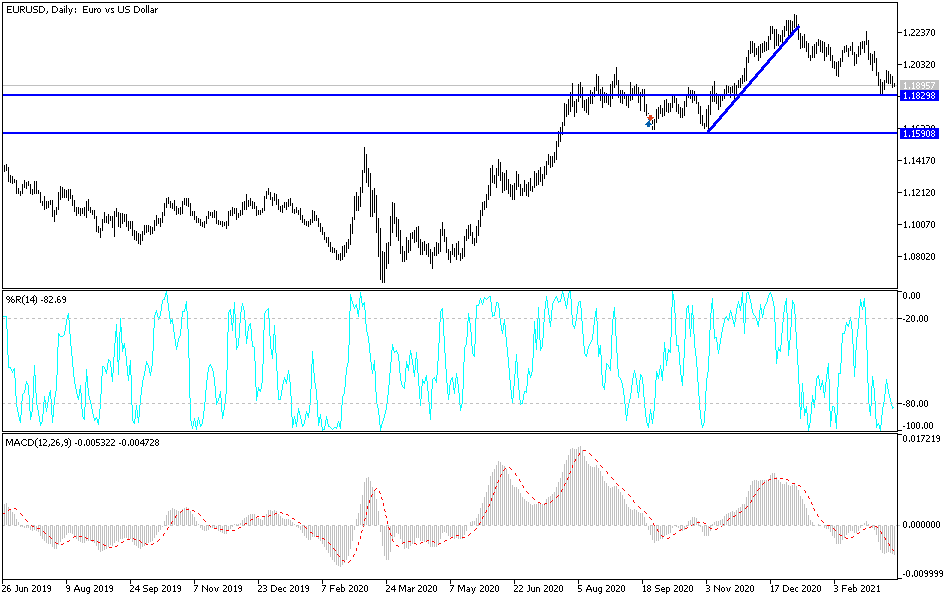

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, the EUR/USD currency pair appears to be trading within the formation of an ascending channel that lacks momentum, which stems from a larger bearish channel. It appears that the bulls are trying to reverse the trend after giving up the psychological peak of 1.2000. Accordingly, they will look to extend the recovery towards 1.1935 or higher to 1.1971. On the other hand, the bears will be looking for short-term gains around 1.1873 or lower at 1.1836.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a bullish channel formation, which indicates significant long-term bullish momentum in market sentiment. The recent bounce has prevented the pair from crossing into oversold levels in the 14-day RSI. Accordingly, the bulls will be looking to ride this bounce by targeting profits at around 1.2019 or higher at 1.2183. On the other hand, the bears will target long-term gains around 1.1773 or lower at 1.1609.

Today's economic calendar:

First, the Consumer Price Index reading in the Eurozone will be announced. Then the US housing data, building permits and housing starts. Then, the interest rate decision of the Federal reserve, its monetary policy statement, the updated expectations for the US economy, and the statements of the bank’s chairman, Jerome Powell, are expected.