The EUR/USD has stabilized around the 1.1760 support level, the lowest in four months, as of this writing. As I mentioned before, the increase in coronavirus infections in Europe and the return of many European economies to strict closure restrictions will increase the pressure on the euro. Also, the problems of buying vaccines in Europe risk seeing the continent lag behind competitors in any economic recovery that may eventually occur, and it is the origin of the series of increasing declines in the value of the euro in the Forex market recently.

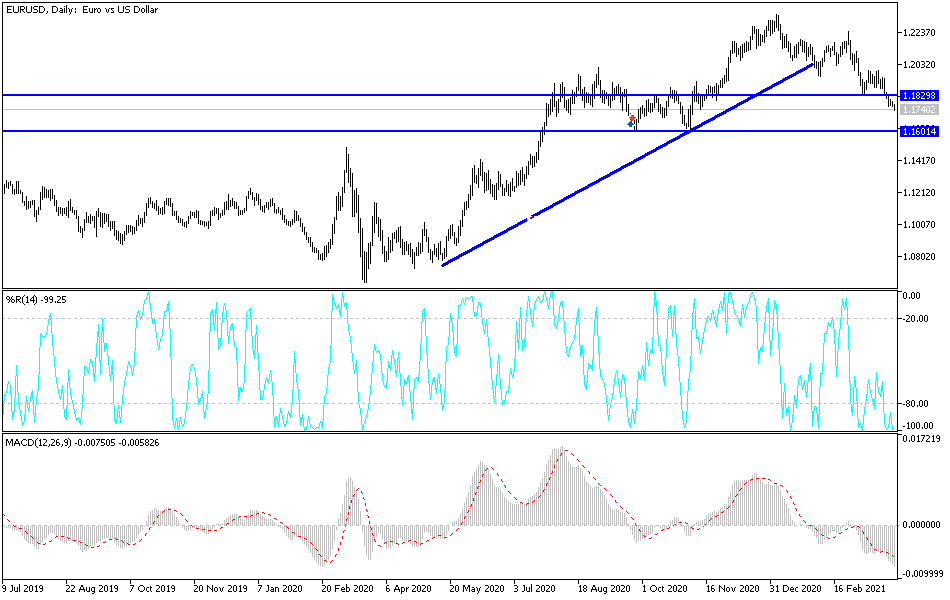

Commenting on the future of the EUR/USD in light of that pessimistic outlook. Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says: “The EUR/USD pair is at its lowest levels for this year, and we expect a slide to the 1.1695 range and then to 1.1600. Also, advances will find initial resistance at the 200-day moving average at 1.1864, then the near-term trend at 1.1887."

Doubts about whether an investment agreement between the European Union and China will be ratified at any time may be responsible for some of the declines in the EUR/USD pair last week, as happened before the IHS Markit PMI surveys indicated that Europe owes most of the March manufacturing boom to external demand. China is the bloc's second largest trading partner and a particularly important market for German auto manufacturers, although tensions with the world's second largest economy were not the only political or geopolitical opponent of the EUR/USD last week. The German Constitutional Court was also heard again, while the US dollar strengthened itself based on other factors.

Technical analysis of the pair:

On the daily chart, the price of the EUR/USD pair is still stable around the strongest support levels. The test of the support level of 1.1760 gave the technical indicators the opportunity to move towards strong oversold levels, and despite that pressure factors are still in place, continuing losses. Coronavirus restrictions will remain a negative factor for any EUR gains in the near term. The disagreement over European economic support plans is also an additional factor. The vaccine delay in Europe and the resulting economic weaknesses necessitate the depreciation of the euro relative to the currencies of the better-performing economies, although the decline of the euro against the dollar has an effect that makes it difficult for other regional currencies to also depreciate as well in general.

The closest targets for the bears are currently 1.1700, 1.1655 and 1.1580. No strong bullish reversal for the currency pair will occur without breaching the 1.2000 psychological resistance again. Otherwise, the general trend will remain down.

The Spanish and German Consumer Price Index will be announced. Then there will be the announcement of the US Consumer Confidence Index reading.