The EUR/USD pair collapsed to the 1.1893 support level last week, its lowest in nearly four months, before closing the week's trading around 1.1912. Last Friday's trading session was disappointing for euro investors, as the US dollar surged based on strong US job numbers for the month of February. Before that, the dollar was supported by the bond market, along with the continuation of European restrictions and a slow vaccination pace.

The euro collapsed along with most of the other major currencies as US bond yields and some other bonds rose to their highest levels before the pandemic, upsetting stock and commodity markets in the process before pushing the EUR/USD down below 1.20 psychological support.

US bonds were sold in a benign sell-off that increased after Fed Chairman Jerome Powell said that the resulting rise in yields simply reflects the US economic outlook, indicating that the US central bank does not intend to race to catch a bear market the way some clearly hoped.

The bonds could be sensitive to potential congressional approval of a $1.9 trillion support package for households, businesses and local governments, although markets have known about them for some time. Earnings also appeared to have lost momentum on Friday after the jobs report showed that the US economy created twice the number of jobs expected last month.

The US dollar was the main top performing currency last week, but it is impossible for speculators to determine whether the gains reflect the desire of investors who have been drawn to them through improved yield and growth prospects, or whether they are merely the result of profit-taking that has been stimulated by little more than market volatility.

The euro will be affected by the European Central Bank’s monetary policy decision on Thursday, which may see the bank attempt to lay a floor under the bond market in the Eurozone, although it is not clear what effect this will have on the euro’s price against dollar due to its typically mixed responses. The decision will be announced on Thursday at 12:45, and will be followed by a press conference by European Central Bank Governor Christine Lagarde at 13:30 on the same day. Commenting on this, Andrew Kenningham, Chief European Economist at Capital Economics, says: “We expect the European Central Bank to raise its inflation forecast in 2021 and lower its forecast for GDP growth, but we stress that inflation is still likely to fall short of the 2% target in the medium term. By changing its policy settings, the focus will be on the bank's efforts to explain how and when it will increase bond purchases in response to rising bond yields.”

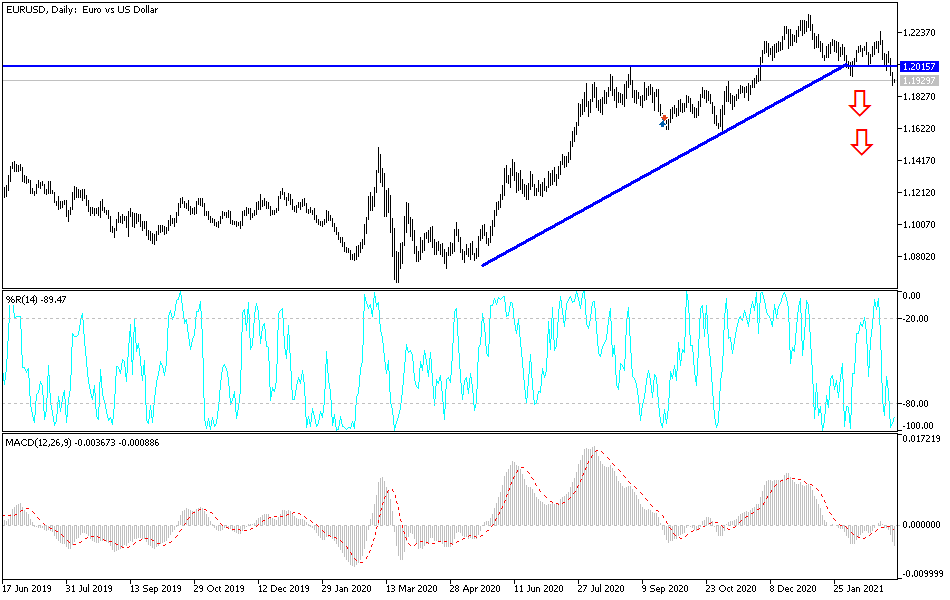

Technical analysis of the pair:

On the four-hour chart, the EUR/USD pair fell, pushing the technical indicators towards strong oversold levels. Buying levels are likely to be at 1.1880 and 1.1790. The 1.2000 resistance is still a guide for the bulls to return to the upside. On the daily chart, there are some technical indicators to oversold levels, and some indicators point to an opportunity for more weakness to move to the same levels. In general, we see the possibility of a bounce by buying the pair from the mentioned support levels, and the gains in the euro will remain under pressure until the European Central Bank announces its monetary policy decisions.

Today, the euro will be affected by the announcement of the German industrial production rate and the Sentex Investor Confidence Index in the Eurozone. There are no significant US economic releases today.