For the second week in a row, the EUR/USD is continuing its bearish correction. The pair reached the 1.1835 support level, the lowest in over three months, before stabilizing around 1.1860 at the time of writing. The euro faces more headwinds as COVID restrictions continue to weaken the economic activity of the Eurozone, led by Germany, and the pace of vaccinations is still weaker compared to other global economies. The US dollar is getting better luck as a safe haven, and benefiting from stimulus plans and recent US job numbers.

Survey data from Sentix showed that investor confidence in the Eurozone improved to its highest level in more than a year this March as the closings had little negative impact. Accordingly, the Investor Confidence Index advanced to +5.0 in March from -0.2 in February. It was the highest reading of the index since February 2020 and higher than economists' expectations of 1.9.

The Research Center said that the data indicated that the economic recovery in the Eurozone continues.

The Current Conditions Index came in at a one-year high of -19.3 versus -27.5 in the previous month. Meanwhile, the Expectations Index rose moderately to 32.5 from 31.5 a month ago. On the positive side, the COVID-19 pandemic appears to have peaked at the global level, and vaccination is progressing well in terms of the number of vaccinated individuals increasing and statistics indicate that effective protection from vaccination is being achieved, Sentex said. These trends allow for a faster opening of the economy.

In Germany, investor confidence reached its highest level since November 2018. The Confidence Index rose to 11.9 in March from 8.6 a month ago. The Current Conditions Index improved to -9.5 from -15.5, while the Outlook Index was stable at 35.8. The survey was conducted among 1,218 investors between March 4 and 6.

The Global Investor Confidence Index rose to a three-year high of 20.5 in March from 17.5 in February.

Data from Destatis, the German statistics agency, revealed that German industrial production unexpectedly declined in January due to weak construction production. Industrial production fell - 2.5% month-on-month in January, while economists expected a 0.2% increase after jumping 1.9% in December. Commenting on this, Commerzbank economist Ralph Solvin said that these numbers should not be interpreted as an indication that the recovery in the production sector is indeed over. The economist added that by spring at the latest, the trend in industrial production should point to the upside again and support the strong recovery of the entire economy expected after that.

Andrew Cunningham, an economist at Capital Economics, said: “Although the decline in industrial production was largely due to a recession in construction and a shortage of semiconductors in the automotive sector, the weak January figure is another reason to believe that the GDP for the forst quarter will contract, perhaps very sharply. ”

On an annual basis, industrial output fell 3.9%, which was larger than the 1% decline in December. Compared to February 2020, the month before restrictions were imposed due to the coronavirus pandemic in Germany, production fell 4.2% in January. Excluding energy and construction, industrial production fell 0.5% month-on-month in January. Energy production rose 0.6%, while construction production decreased 12.2% due to the strong base effect and the end of the value-added tax cut.

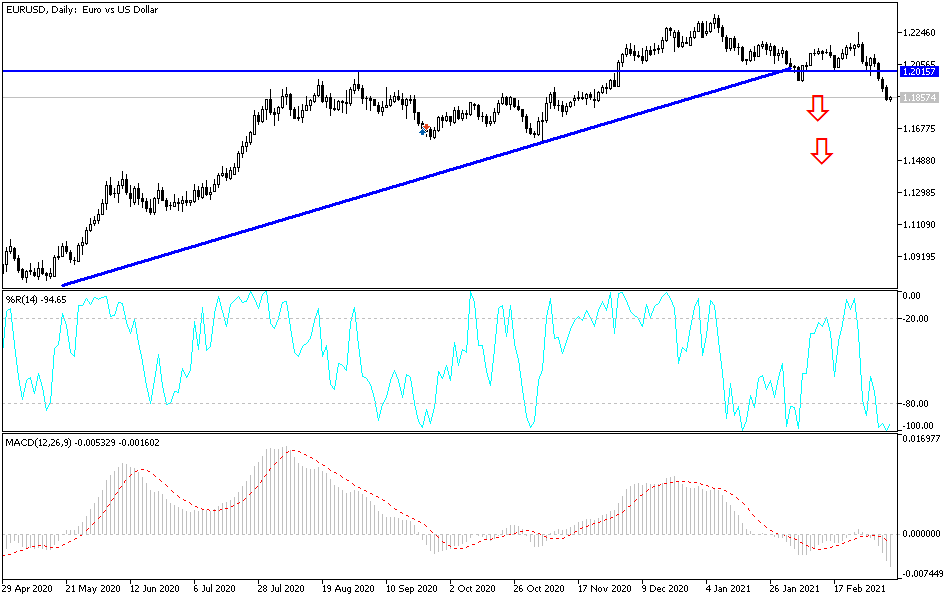

Technical analysis of the pair:

The bearish performance of the EUR/USD pair has caused recent losses to grow, pushing the technical indicators to strong oversold levels. This week’s trading may remain calm as the markets do not expect any influential economic data, and therefore investor risk sentiment will have the strongest impact on the pair's performance. The euro is waiting for the return of investor risk appetite and any announcements about European progress in vaccinations and the abandonment of COVID restrictions. The bulls are waiting for a chance to settle above the 1.2000 resistance for momentum to move higher again. At the same time, the bears will have to breach the 1.1800 support, an important target for testing more stronger support levels. I now see better buying levels as 1.1810, 1.1740 and 1.1690.

For the second day in a row, the economic calendar is devoid of important US economic data, and today's focus will be on announcing the growth rate of the Eurozone economy, the rate of change in employment and the German trade balance.