After trying to correct upwards for six trading sessions in a row, the EUR/USD's rebound gains did not exceed the 1.2243 resistance level. Gains reached the 1.2062 support level before closing the week’s trading around the 1.2072 level, in a decisive confrontation with the 1.2000 psychological support which may open the door for bears to test stronger support levels. Commenting on the recent performance, Dominic Puning, Head of Forex Research at HSBC wrote in a report released in early January that “there is still little evidence of reserve managers fleeing the US dollar as the primary reserve currency of choice, and now the euro is struggling to take advantage of the modest collapse of the US dollar.”

The US Dollar Index declined in the third quarter of 2020 while the euro rose against the dollar, both of which are negatively related to the trend of their total share in the foreign exchange reserve baskets of central banks. This indicates that the dollar grew its share of the basket in the third quarter of last year, while the euro saw a decline in its share.

Drag Maher, Head of Forex Strategy at HSBC, said: “The retracement of the US dollar is a reminder that the currency’s reaction to the topic of global deflation is not straightforward. History shows that the US dollar usually weakens during global economic upturns, and it is assumed that it is the victim of the reflection of appetite for safe havens and the abandonment of risky assets. Our bearish outlook for the US dollar remains.”

Official figures confirmed that the gross domestic product of the United States of America jumped slightly higher than the original estimates in the fourth quarter of 2020. The gross domestic product of the largest economy in the world grew by 4.1% in the fourth quarter of 2020 compared to the recorded increase of 4.0% in the previous quarter. The upward revision matched economists' estimates. Slightly stronger GDP growth mirrored the upward revisions in steady residential investment and private stock investment. However, the upward adjustments were partially offset by a modest review of consumer spending, which jumped 2.4% compared to the previously reported jump by 2.5%.

Revised data released by the University of Michigan showed that US consumer sentiment deteriorated slightly less than initially expected in February. The report showed that the US Consumer Confidence Index for February was revised upward to 76.8 from the initial estimate of 76.2. The revised reading was higher than economists' estimate of 76.5, but still below January's final reading of 79.0.

Commenting on the results, Richard Curtin, Chief Economist of Consumer Surveys, said: "All of February's losses were due to households with incomes below $75,000, with declines mainly focused on future economic prospects. Perhaps the worst of the epidemic is nearing its end, but few consumers expect the type of continued and strong economic growth that returns employment conditions to very positive levels before the epidemic."

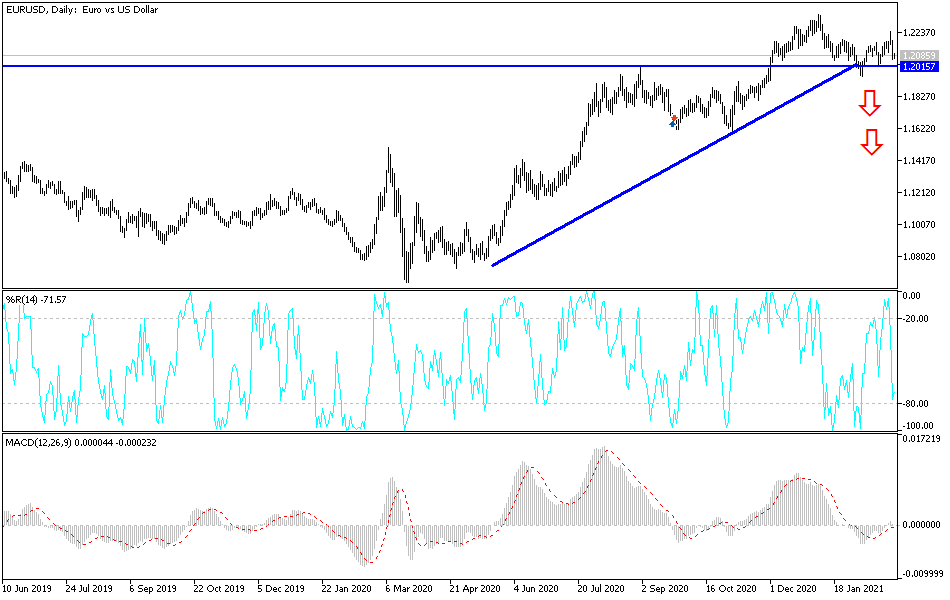

Technical analysis of the pair:

On the daily chart, the EUR/USD has remained above the 1.2000 resistance that still supports the bullish outlook so far. Its breakout confirms the breach of the general trend and thus a willingness to test stronger support levels, the closest of which are 1.1975 and 1.1880. I still see that the euro’s gains will be sold off if the European vaccination rate continues, lagging behind the rest of the other global economies. On the upside, the bulls still need to breach the 1.2300 resistance again to confirm a strong bullish future.

Today's economic calendar:

The German Consumer Price Index (CPI) reading and the Industrial Purchasing Managers Index (PMI) readings for Eurozone economies will be announced. Later, there will be new statements by European Central Bank Governor Christine Lagarde. Following that, there will be the announcement of the US ISM Manufacturing PMI reading and the US Construction Spending Index.