The EUR/USD pair's losses during last week’s trading culminated in a move towards a 4-month low, reaching the support level of 1.1761 before closing steadily around 1.1792. The pressure factors on the euro are still continuing, and consequently, any gains for the euro will still be a target for selling. The most prominent pressure factors were the return of European restrictions to contain increasing COVID infections, as well as the obstacles towards vaccination plans against the epidemic.

Therefore, the euro is expected to continue its weakness against the US dollar as the delay in launching the European rescue fund combines with a slow vaccination program and a rapid spread of the COVID-19 virus to cast a shadow over the Eurozone. In France, Italy and Germany, COVID-19 infection numbers are rising dramatically, indicating that a third wave of infections is now underway.

In Germany - the largest economy in the Eurozone - 21,573 new infections were reported at the end of last week, an increase of 4,271 from the previous week. The 7-day incidence rate - the total number of people infected with corona in the past seven days - jumped to 119.1 per 100,000 people. The speed of new infections indicates that the relatively slow introduction of the vaccine in the country is unlikely to stop a new wave, which would delay any economic recovery after the outbreak of the virus and reflect badly on the euro.

The euro’s exchange rate has plummeted against the dollar to below the psychologically important 1.20 level recently.

The European Recovery Fund was approved in May 2020 and sought to distribute 750 billion euros across the bloc to mitigate the economic and financial impact of the COVID-19 crisis. Hence, the opportunity for the euro to rise in the wake of the agreement, but the subsequent delays in the distribution of the fund, were cited by analysts as a possible contributing factor to the current wave of euro weakness. The distribution of funds may be delayed due to bureaucracy as national parliaments work through their own legislation required to pass the plan, and at the same time the European Union’s executive branch is delaying approval of individual spending plans for some countries.

It was reported on March 12 that the Recovery Fund had early problems with the bloc’s executive arm, which ruled that most of the national spending plans submitted so far had yet to work to obtain approval. Accordingly, economists expect the fund, upon approval, to support economic activity in the bloc, which is said to ultimately support the euro.

Accordingly, analysts say that this support for the US economy is one of the reasons that the performance of the US dollar is better than many expected at the beginning of the year. Meanwhile, growth prospects in the Eurozone remain weak given the renewed spread of the COVID-19 virus across the bloc, leading to expectations that restrictions on economic activity will last longer than previously anticipated.

BMO Capital expects the exchange rate for the EUR/USD to be around 1.17 in three months and around 1.18 in six months.

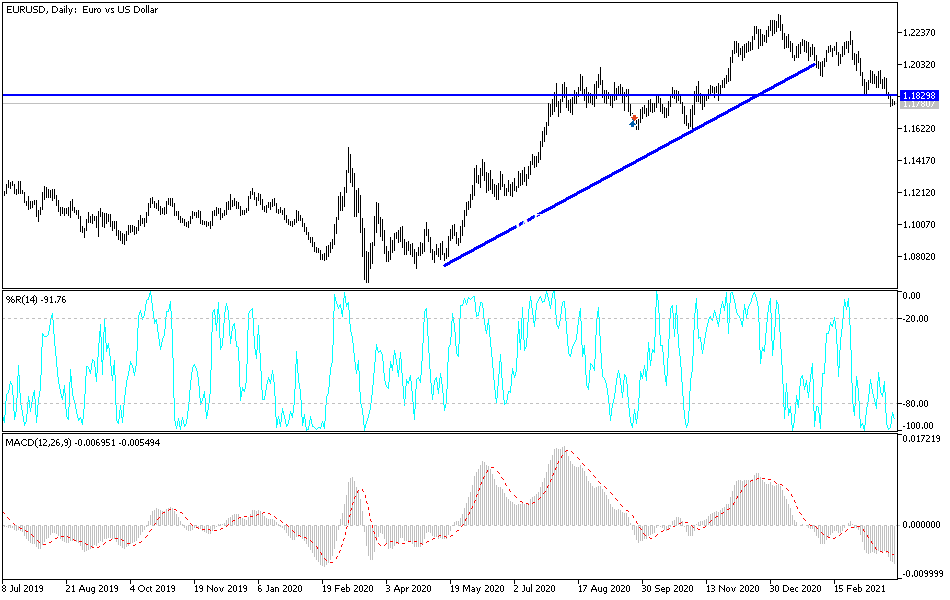

Technical analysis of the pair:

After the above explanation, it seems clear that the reasons for the decline in the EUR/USD and the continuation of these factors means a further collapse of the price, and stability below the support 1.1800 still supports the bears in moving towards stronger support levels, the closest of which are 1.1765, 1.1690 and 1.1600. The second and third levels are most appropriate for considering buying the pair as a prelude to the stage of retracement and correction. On the upside, I still see that the 1.2000 psychological resistance will remain a distinct target for bulls and an exit from the current bearish channel.

The currency pair does not expect any important data today, whether from the Eurozone or the United States of America, and accordingly, investor sentiment will be the main driver of the pair.