The EUR/USD pair's performance this week continues to be bearish, with losses hitting the 1.2027 support level before stabilizing around 1.2050 as of this writing. Last week's losses had reached the 1.2062 support level. The euro remains vulnerable to further losses against the US dollar in the short term. The EUR/USD suffered a 107-point decline before the weekend, which represents the biggest daily decline for the pair since April 2020, and analysts believe that the sharp decline amounts to a confidence shock that fell near the potential bullish range. "The biggest daily drop in the EUR/USD since April weakens the daily chart," said Martin Miller, a market analyst at Reuters who studies the euro outlook.

The dollar rose against most of the G10 currencies over the end of last week, supported by higher returns on US government debt, and in particular the yield on 10-year US government bonds. Thus, how the dollar and EUR/USD trades over the coming days could depend on how the US fixed income market behaves.

Francesco Bisol of ING Bank N.V. said: "With the 10-year US Treasury yields now back at 1.40% and the recovery in Asian stocks, the corrective dollar rally should take a break." The yield on 10-year bonds has increased in most major economies as investors expect higher inflation rates in the future thanks to the global economic recovery. Investors are selling the bonds as inflation expectations rise and they are demanding more compensation in the form of return on holding the bonds.

But this, in turn, leads to higher financing rates for companies, which leads to the selling of shares.

Meanwhile, the rise in the 10-year yield in the United States has been faster than in other countries as investors see the US economic recovery as more sustainable and advanced, particularly due to expectations for a large aid package from the Biden administration. This, in turn, has led to the dollar's rally in recent days.

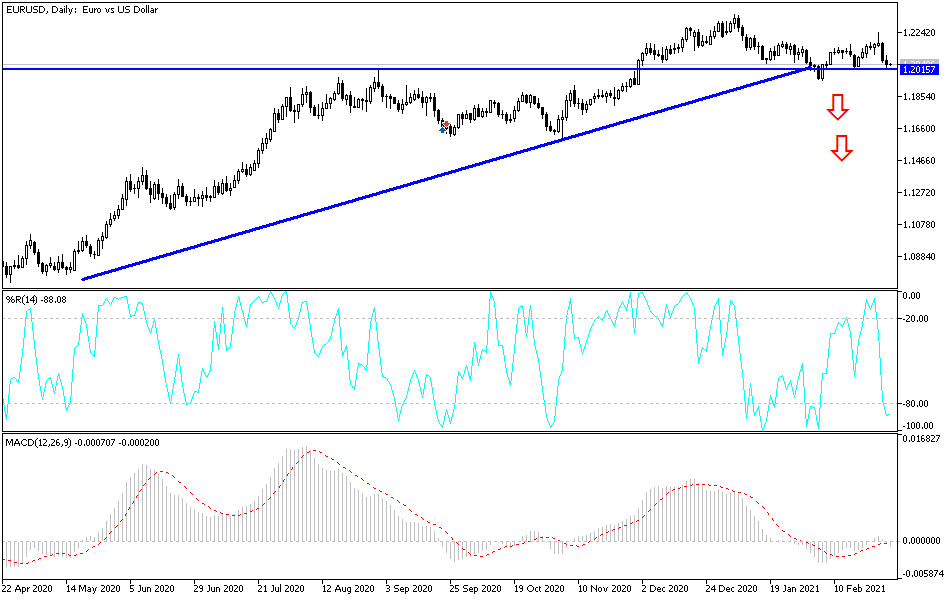

Karen Jones, Head of Technical Analysis Research Team at Commerzbank, says the EUR/USD pair has failed again at the key technical level of 1.2190. Last week, the pair attempted to breach the upside, but failed to maintain the movement to the upside and as a result, this week began in a defensive position with focus on the 1.2037 level and the September high at 1.2014. This protects the main short-term support, which lies at the 1.1945 support level, and analysts believe that a close below 1.1945 support is necessary to indicate deeper sell-offs to the 1.1750 support and possibly the 1.1695 / 02 support, which is a 38.2% retracement and the September and November lows. It could also represent a return to the exit point from the 12-year downtrend, Jones adds. "Only the upside breakout above 1.2243 resistance means a re-test of the resistance 1.2349, Jan 6th high."

Preliminary figures from Destatis, the European statistics agency, showed that German consumer price inflation rose higher than expected in February. The index rose 1.3% year-on-year after a 1.0% increase in January. Economists had expected inflation of 1.2%. Prices rose for the second month in a row.

Compared to the previous month, Germany's Consumer Price Index rose by 0.7% in February after increasing by 0.8% in January. Economists expected a gain of 0.5%. On the basis of the European Union's HICP measure, the inflation rate was stable at 1.6% in February. This was in line with economists' expectations.

The Eurozone manufacturing sector saw growth at a faster-than-expected pace in February, which was the strongest in three years as production and new orders grew sharply amid a rebound in demand for exports.

Technical analysis of the pair:

The attention of Forex traders is on the level of psychological support at 1.2000. A breakout below this level would mean more technical selling and thus testing stronger and closer support levels after that at 1.1955, 1.1880 and 1.1800, which are sufficient to push technical indicators to strong oversold areas on the daily chart. On the upside, there will be no new opportunity for the bulls to control the performance without settling above the resistance at 1.2200. Investor risk appetite, the global vaccination pace, and COVID-19 will continue to be the strong influencing factors on the currency pair.

Today's economic calendar:

Regarding the euro, German retail sales and jobs numbers for Spain and Germany will be announced, and then the Consumer Price Index reading in the Eurozone will be released. Regarding the dollar, there will be statements by some officials regarding the monetary policy at the US Federal Reserve.