Bears are still controlling the performance of the EUR/USD pair as US monetary policy officials are still confident in the future of the country's economic recovery amid vaccinations and economic stimulus plans. In contrast, in Europe, there is a slow pace of vaccinations, a weakening of stimulus plans, and the imposition of more restrictions to contain the increasing numbers of infections there. Accordingly, it was natural for the bearish momentum to continue for the EUR/USD, which tested the support level of 1.1842 and settled around there at the beginning of the trading session on Wednesday.

The exchange rate of the euro against the dollar is under pressure amid signs that the COVID-19 pandemic in the Eurozone is growing, leading to lockdown restrictions and expectations that the bloc will lag behind others in economic recovery. Accordingly, a number of analysts expect that the most popular currency pair in the world is on its way to test the 200-day moving average in the coming days, but the decline is likely to be relatively short-lived, according to analysts at ING Bank. Accordingly, the Dutch-based lender and investment bank inform clients in a regular weekly currency briefing that the euro could regain the psychologically significant 1.20 mark in the coming weeks.

However, the key to any recovery requires that the global investor's background turn into a constructive one, which analysts usually think to be supportive of the EUR/USD rally. However, the fundamental factor driving the EURUSD rate is challenging at the moment, given the emerging sharp contrast between economic performance in the European Union and the United States and the outlook.

The acceleration of the vaccine rollout in the United States was coupled with a massive government stimulus package of $1.9 trillion, which stimulated demand for the dollar, causing the currency pair to tumble below 1.20 earlier in the month.

Market analysts and commentators point the finger at the rise in cases of COVID-19 in Europe, as major economies in the region enter tighter lockdowns. Recently, Germany announced that it would tighten restrictions to cover the Easter period, hoping that infection rates would not diminish during the holiday period.

Analysts believe that the developments mean that the EUR/USD is now exposed to the risk of testing the 200-day moving average at 1.1850, “below which there is no more support until the downside of the downside channel at 1.18”.

Also in a pessimistic outlook, Lars Merklin, Chief Analyst at Danske Bank, says that since the new lockdowns began in Europe, the negative effects on domestic demand have become apparent. This contrasts unfavorably with the United States, where the trend in financial and investment asset performance remains strong, and the COVID-19 pandemic has accelerated technology adoption. Accordingly, this month Danske Bank indicated to clients that they are lowering their EUR outlook based on emerging economic divergence, adding that signs of a slowdown in the Chinese economy are potential additional EUR headwinds.

Danske now expects the EUR/USD exchange rate to be at 1.19 in one month, 1.18 in three months, 1.17 in six months, and 1.15 in 12 months. This is a decrease from previous expectations of 1.22, 1.22, 1.19 and 1.16, respectively.

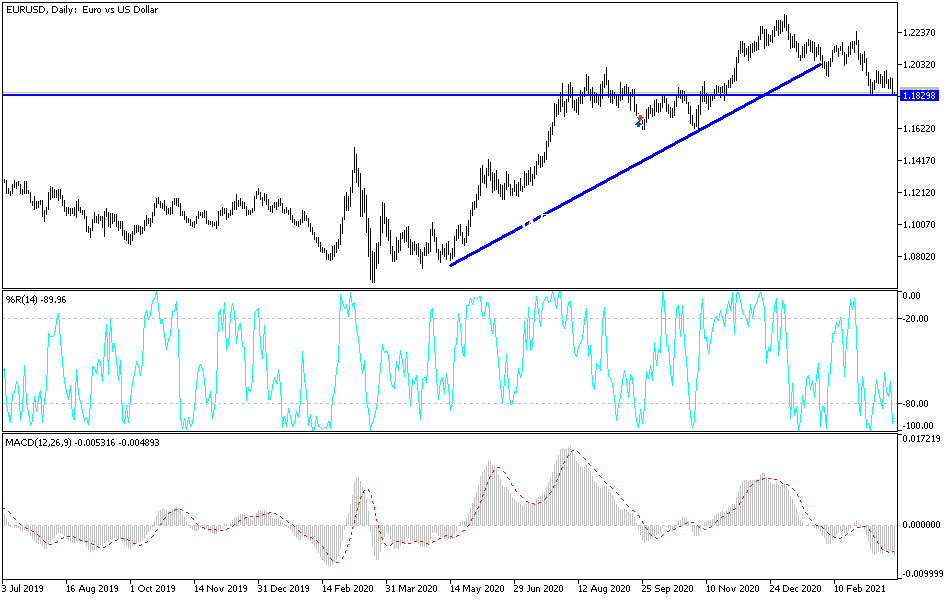

Technical analysis of the pair:

The bears will dominate the performance of the EUR/USD by moving towards the 1.1800 psychological support level, and moving below it heralds a stronger downward move to the levels of 1.1775 and 1.1690. It may happen if things get out of control in Europe towards containing the increasing numbers of infections. On the upside, the bulls will not return to control performance without breaching the 1.2000 psychological resistance level again.

Today, the currency pair will also be affected by the PMI readings for the manufacturing and services sectors for the Eurozone economies. Later, there will be an announcement of the consumer confidence reading in the bloc. From the United States, the durable goods order numbers will be announced, followed by the second testimony from Federal Reserve Governor Jerome Powell.