During yesterday's session, and for the fourth day in a row, the EUR/USD pair attempted to breach the psychological support level of 1.2000. Yesterday's rebound attempt reached the resistance level at 1.2113 before settling around the support level of 1.2050 at the time of writing. The weakness of the private sector in the Eurozone, which was offset by a strong decline in the US jobs numbers in the non-agricultural sector, according to the ADP survey, caused the fluctuation in the performance of the EUR/USD. The pair now holds below the 38.20% Fibonacci level on its way up after the drop in late February which reached as low as the 1.2000 level on Tuesday. The pair remains below the 100-hour and 200-hour simple moving average lines on the hourly chart.

It was announced that the EU core CPI reading for February matches the expected change (year-on-year) of 1.1%. The general Consumer Price Index for the same period was lower than the expected change (year-on-year) by 1% with a change of 0.9%. The Composite PMI - which includes both the manufacturing and services sectors - in the European Union for February beat expectations at 58.1 with a reading of 58.8. The Service PMI also outperformed, while January's PPI outperformed both monthly and annually.

There was disappointment in the US markets, as the ADP survey monitored the registration of only 117 thousand jobs in the non-agricultural sector, instead of the expectations that indicate the monitoring of 177 thousand jobs. The ISM Services PMI for the month came in below 58.7 with a reading of 55.3. The ISM Services New Orders index was also below expectations, while the employment rate in services and paid prices both beat expectations. Earlier this week, the US ISM Manufacturing PMI for February was announced to have beaten expectations of 58.8, with a reading of 60.8. The ISM Manufacturing Price Index Paid and New Orders Index also beat expectations.

German leaders are looking for ways to ease the country's long-running coronavirus lockdown, which they are expected to extend while the door also opens to ease some restrictions. German Chancellor Angela Merkel and the country's 16 state governors are looking for ways to balance concern about the impact of more contagious variants of the coronavirus with the growing need to return to a more normal life.

Merkel and the Conservatives, who in a highly decentralized Germany have the power to impose and lift restrictions, are expected to extend the lockdown in principle for three weeks until March 28. The first restrictions have already been relaxed. Many elementary school students returned to school a week ago. On Monday, the hairdressers opened after a two-and-a-half-month break. Some German states have also allowed businesses such as florists and hardware stores to open on Monday. Most of the stores across the country have been closed since December 16. Restaurants, bars, sports and entertainment facilities have been closed since November 2, and hotels are only allowed to accommodate business travelers.

When the last meeting took place on February 10, Merkel and the governors set a goal of 35 new cases per week per 100,000 people before allowing convenience stores, museums and other businesses to reopen. The goal is to enable trusted contact tracing. But reaching this goal soon seemed increasingly unrealistic with the increase in cases of the most contagious type first discovered in Britain, and with the number of infections increasing overall. The number of cases per week, which peaked at around 200 cases per 100,000 population just before Christmas, has stopped at 60 in recent days.

The CDC said that 9,019 new cases of coronavirus were reported during the past 24 hours, bringing the total number so far to 2.46 million. There were another 418 deaths in the country of 83 million people, bringing the death toll in Germany to 70,881.

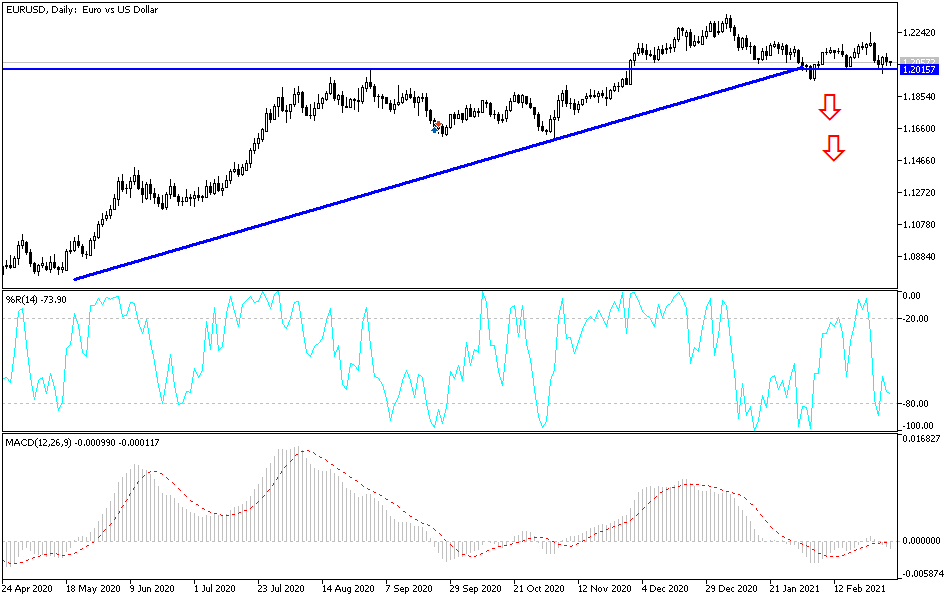

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD pair has recently rebounded from its 3-week low after a decline at the end of February. It is now settling below the 38.20% Fibonacci level on the way up. Therefore, the bulls will look to extend the current short-term recovery towards 1.2117 or higher at 1.2146. On the other hand, the bears will be looking to maintain control in the short term by targeting profits at around 1.2051 or below at 1.2024.

In the long term, and based on the performance on the daily chart, it appears that the EUR/USD is trading within a sharp rising wedge formation, which indicates significant long-term bullish momentum in market sentiment. Accordingly, the bulls will look to maintain long-term control over the pair by targeting profits around 1.2197 or higher at 1.2303. On the other hand, the bears will be looking to pounce on pullbacks around 1.980 or below at 1.1884.

The euro will be affected today by the release of the European Central Bank's monthly report, retail sales and the unemployment rate in the Eurozone.