Last Thursday’s EUR/USD signals were not triggered, as the bearish price action occurred slightly above the nearest resistance level which was identified at 1.1985 that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today only.

Short Trade Ideas

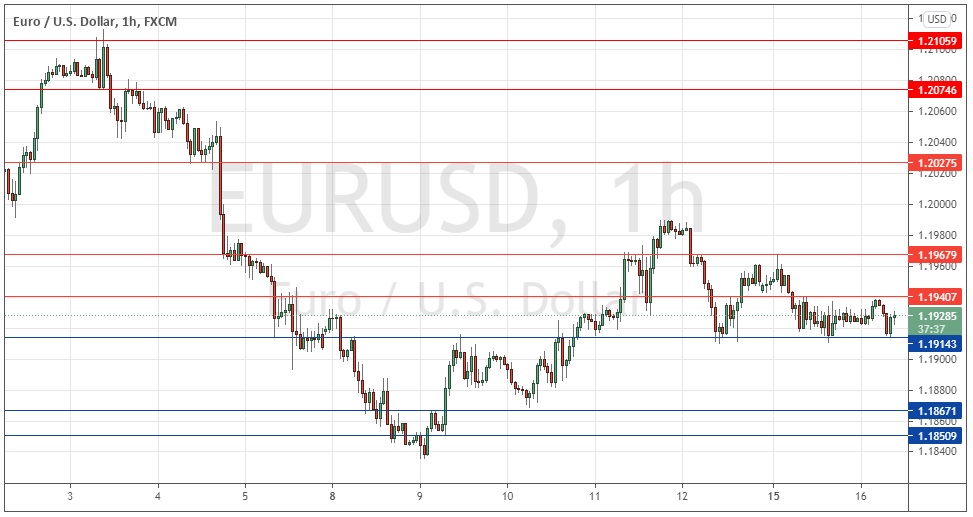

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1941, 1.1968, or 1.2028.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1914, 1.1867, or 1.1851.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that this currency pair had a line of least resistance which was upwards so the price was poised to jump higher still, but much would depend upon the content of what the ECB did later that day.

I therefore saw the best approach as waiting to see the impact of the ECB release and if it was pushing up the price, to trade this pair long on short time frames.

This was a good and profitable call, as after an initial bearish reaction, the price did push up and was easy to trade long almost as high as 1.2000, before it sold off again.

The technical picture now is very evenly balanced between bulls and bears on all time frames – there is no long-term trend. Over the short-term, the price is consolidating within a very narrow range from 1.1914 to 1.1941.

Despite the even balance, I see today’s pivotal point as most likely to be the support level at 1.1914, so a carefully managed long trade from there on a short time frame after a bullish bounce would probably be the best opportunity. If the price makes two consecutive hourly closes below 1.1914, it will be likely to fall further, with the support near 1.1850 as likely to be very significant.

Regarding the USD, there will be a release of Retail Sales data at 12:30pm London time. There is nothing of high importance scheduled for today concerning the euro.