Bearish Signal

Set a sell-stop at 1.1760 (Friday low).

Add a take-profit at 1.1700 and a stop-loss at 1.1820.

Timeline: 1-2 days.

Bullish Signal

Set a buy stop at 1.1833 (neckline of double-top).

Add a take-profit at 1.1900 and a stop loss at 1.1780.

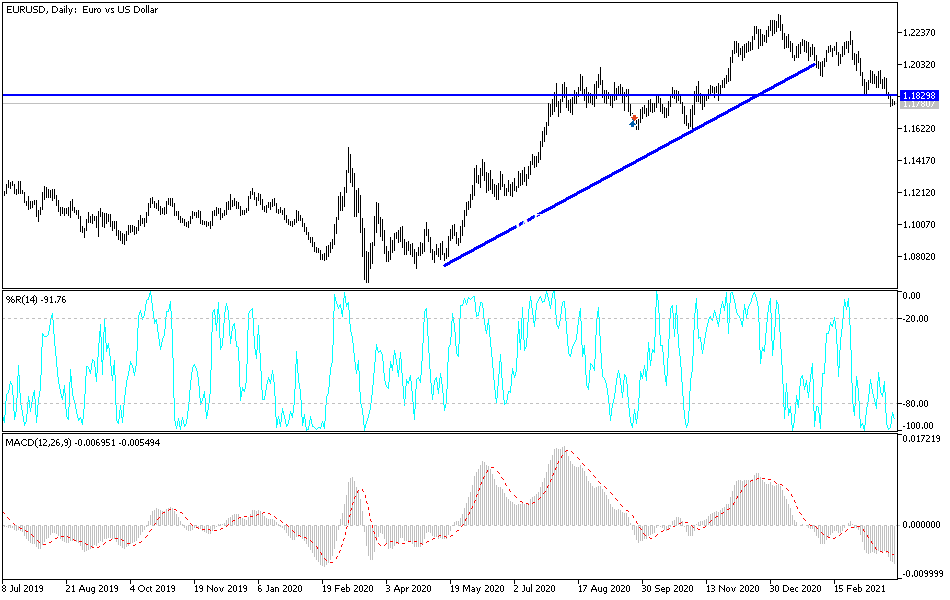

The EUR/USD price is in a tight range as the market watches the crisis at the Suez Canal and the rush to safety following last Friday’s sell-off in some stocks. The pair is trading at 1.1786, which is slightly below the important resistance at 1.1800.

Suez Canal Crisis and Impact to Global Growth

The market is watching the ongoing crisis at the Suez Canal, where experts are attempting to free a giant ship that stuck last week. This ship is blocking more than 300 ships traveling from Asia to Europe and vice versa.

The Suez is one of the most important trade routes in the world. More than 30% of goods worth billions of dollars pass there every day. In a report, Allianz said that the blockage could reduce global trade by about $10 billion per week and reduce between 0.2% and 0.4% from annual trade growth.

The EUR/USD is also in a tight range as investors pay close attention to the American stock market. Last week, some stocks like ViacomCBS and Discovery declined by more than 30%. Other prominent Chinese stocks like Alibaba and Tencent Music also slumped as a hedge fund led by a Tiger Global Alum sold shares.

Therefore, this trend could continue today. Indeed, the Dow Jones and NASDAQ 100 futures have dropped by more than 0.50%. US stocks tend to have an inverse relationship with the US dollar.

There will be no data from the US and Europe today. Therefore, the EUR/USD will watch the happenings in the bond market today. Later this week, the most important numbers will be the final global PMIs and the US non-farm payroll numbers that will come out on Friday. From Europe, the market will react to the latest consumer confidence data and preliminary inflation numbers.

EUR/USD Technical Forecast

The EUR/USD pair is trading at 1.1785, which is in the same range where it ended last week. On the four-hour chart, the price is slightly below the important resistance at 1.1833, which was the lowest level on March 9. It is also slightly below the 25-day and 15-day exponential moving averages and is below the neckline of the double top pattern. Therefore, the pair may break out lower as investors target the next key support level at 1.1720.