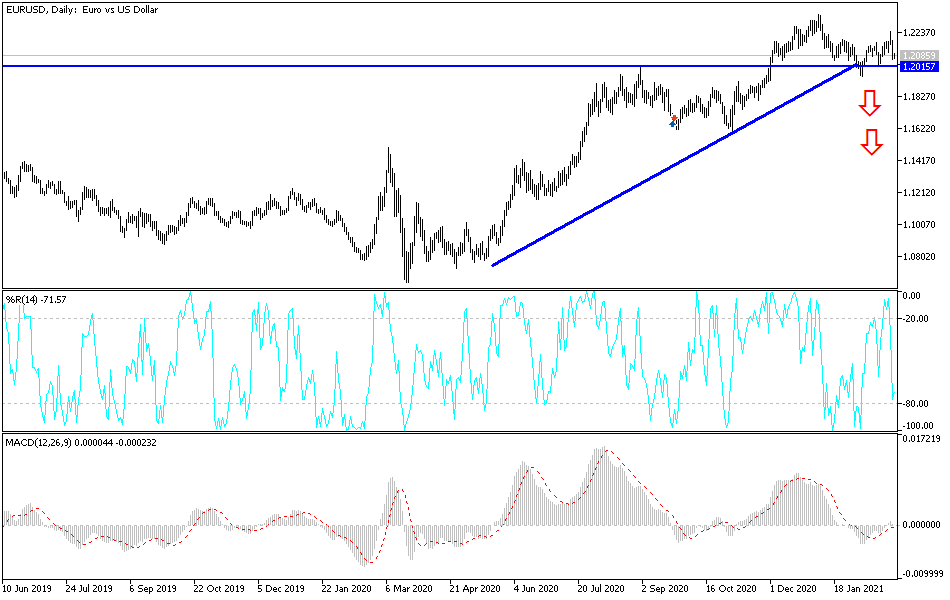

Bearish View

Sell the EUR/USD so long as it is below the 15-period EMA.

Add a take-profit at 1.2020 and a stop-loss at 1.2130.

Bullish Vew

Set a buy stop at 1.2100 and a take-profit at 1.2150.

Add a stop-loss at 1.2060.

The EUR/USD is bouncing back ahead of the important US and European Union Manufacturing PMI numbers. The pair is also reacting to the progress of US stimulus and the retreating Treasury yields.

Manufacturing Data Ahead

Markit will today publish the final February Manufacturing PMI numbers. In general, economists expect these numbers to show that the overall manufacturing sector was relatively steady in February.

In the Eurozone, analysts expect that the Manufacturing PMI rose from 54.8 to 57.7 in February. This performance will be because of countries like Germany, where the PMI is expected to rise to 60.6. The French and Italian PMIs are expected to rise to 55.0 and 57.0, respectively.

In the afternoon session, Markit and the Institute of Supply Management (ISM) will publish the US PMIs. The data from Markit is expected to rise from 58.7 to 58.8 while by Markit is expected to rise to 59.0.

In general, the manufacturing sector has seen a strong performance even as countries implement their lockdowns. On Wednesday, Markit and ISM will publish the Services PMI.

Meanwhile, the EUR/USD will also react to the latest German Consumer Price Index (CPI) data. Analysts expect that the Headline CPI rose from 1.0% in January to 1.2% in February. They also expect that the harmonised consumer inflation rose by 1.6%.

Traders are also focusing on the US Treasury yields. After rising to 1.50% last week, the ten-year dropped to 1.4% in the overnight session. This is partly because some investors believe that the Senate may fail to pass Biden’s $1.9 trillion stimulus.

EUR/USD Technical Outlook

The EUR/USD rose to an intraday high of 1.2100 and then pared back those gains to the current 1.2085. On the hourly chart, the price is between the 78.6% and 61.8% Fibonacci retracement level. It is also slightly below the 25-day and 15-day exponential moving averages while the Relative Strength Index (RSI) is slightly above the oversold level. Therefore, the pair may resume the downtrend and possibly retest Friday’s low at 1.2060.