Bearish View

Sell the EUR/USD anywhere below 1.1920 (78.6% retracement).

Add a take-profit at 1.1833 (last week’s low)

Set a stop loss at 1.1988 (61.8% retracement).

Bullish View

Set a buy stop at 1.1920 and a take-profit at 1.1988.

Add a stop loss at 1.1850.

The EUR/USD price is little changed as traders wait for the latest EU inflation numbers and the FOMC decision.

EU Inflation Data Ahead

Eurostat, the European statistics agency, will publish the latest inflation numbers from the region today. The median estimate by analysts polled by Reuters is for the Headline CPI to rise by 0.2%, leading to an annual increase of 0.9%. The Core CPI, an important figure that excludes the volatile food and energy products, is expected to rise by 0.1% and at an annual pace of 1.1%.

In general, consumer prices in Europe have improved modestly recently because of the ongoing economic rebound as more countries reopen. Higher crude oil prices, Brexit complexities, and the winding down of some tax breaks has helped boost consumer prices. This trend will likely continue in the near term as countries ramp-up vaccinations. However, a new wave of coronavirus in some countries like Germany, France and Italy could slow the recovery.

The EUR/USD is also in a tight range as traders wait for the latest interest rate decision that will come out during the American session. Economists believe that the headline information like interest rates and quantitative easing will remain intact. However, because of the recent $1.9 trillion stimulus package and the vaccination drive, the bank will likely boost its annual economic forecast from 4% to 8%. In a speech, Jerome Powell will possibly talk about inflation and the recent movement in US Treasury yields.

The interest rate decision comes a day after the US published relatively weak retail sales and production data. The overall retail sales declined by 3.0% in February while core sales fell by 2.7% as the impact of the previous stimulus faded. In the same month, manufacturing and industrial production declined by more than 2%.

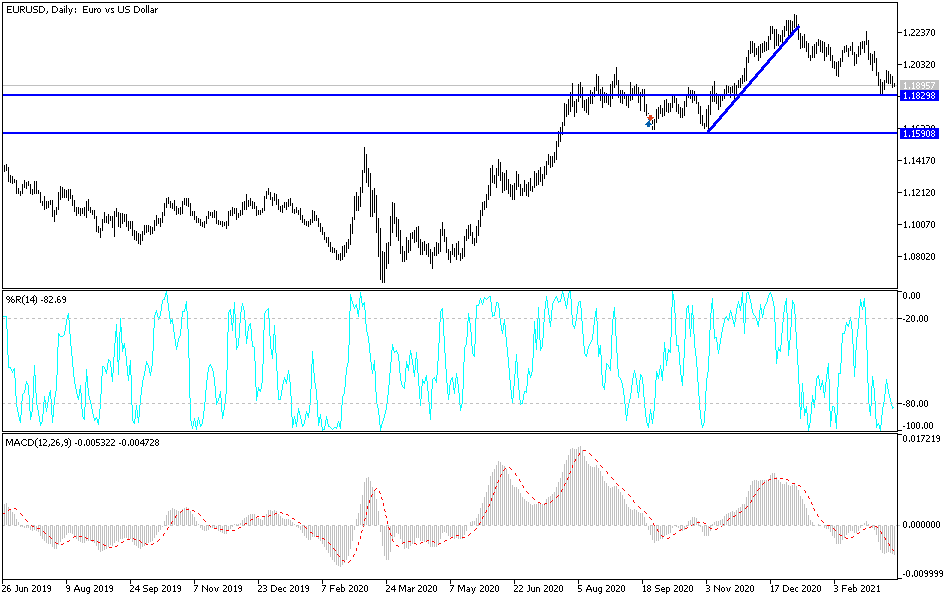

EUR/USD Technical Outlook

The EUR/USD reached a high of 1.1988 last week. This price was along the 61.8% Fibonacci retracement level. Since then, the price has declined by more than 0.70% to today’s low of 1.1880.

On the three-hour chart, the price is slightly below the 25-day and 15-day moving averages and the 78.6% Fibonacci retracement level. It also seems to be forming a head and shoulders pattern, which is usually a bearish signal. Therefore, the pair may keep falling as traders target last week’s low at 1.1833.