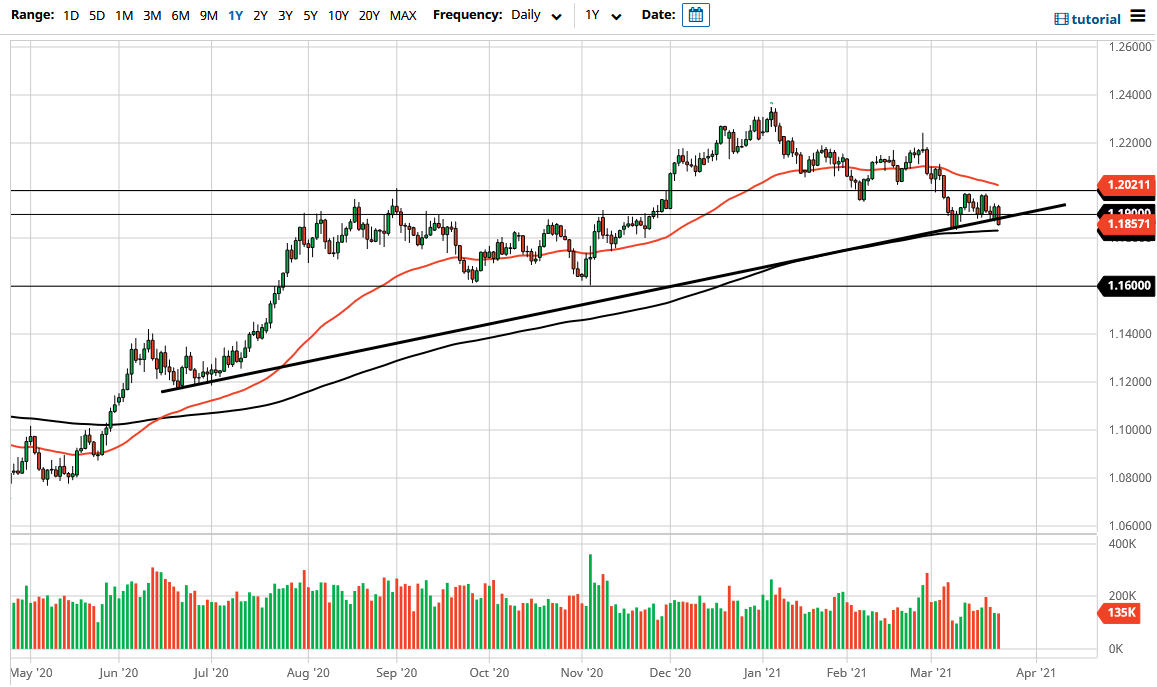

The Euro fell significantly during the trading session on Tuesday as Germany has announced further lockdowns. At this point, it looks like the market is going to try to form a “double bottom”, sitting on the 200 day EMA. At this point, it is going to be a very interesting to see how this plays out, because if we were to break down below the 200 day EMA, I suspect that a lot of quant traders will start shorting the Euro at that point.

Furthermore, I think that we are probably looking at a potential move to the 1.16 level if we do get that breakdown. After that, we could see this selloff accelerate quite drastically. It will be interesting to see how this plays out, but it is certainly starting to see a lot of US dollar strength across-the-board, and therefore it is likely that we will see the Euro be one of the main victims of that attitude.

We are not quite broken down yet, but the fact that we are closing at the bottom of the candlestick tells me that we almost certainly will try to do so. Most traders will look towards short-term charts to start fading at the first signs of trouble, and as a result I think that I will probably be looking at something along the lines of the 50 minute chart in order to get involved. This is a market that looks like it is hanging on by a thread, so I certainly think that we continue to see an attempt to break down. However, if we were to turn around and take out the top of the candlestick from the trading session on Tuesday, then it is very possible that the Euro could go looking towards 1.20 handle above, and of course the 50 day EMA that is sitting just above it.

In general, I still anticipate a lot of negativity but the fact that we have a somewhat definitive candlestick for the day suggests that we still have to favor the downside overall. The 200 day EMA is very widely followed, and I think that will continue to be the case. Pay close attention to the 10 year yield, because of that starts to spike as well, that will almost certainly break this pair apart.