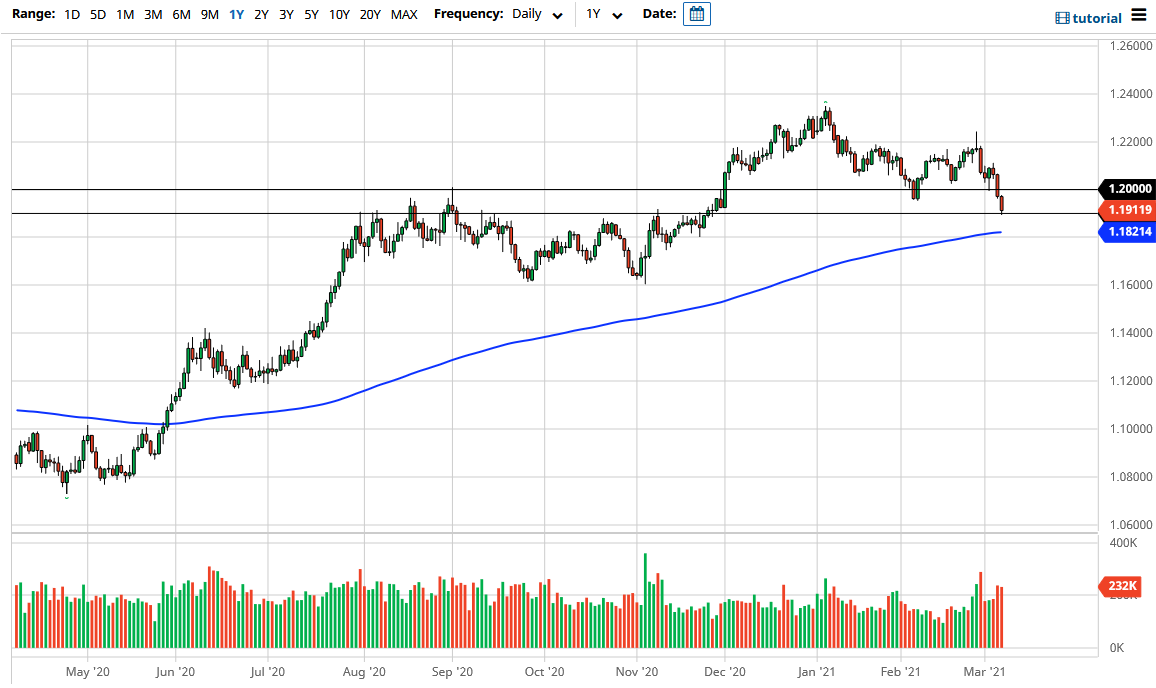

The Euro has fallen somewhat hard during the trading session on Friday to reach down towards the 1.19 level. This is an area that I think is the bottom of the overall consolidation and support level that had been seen at the one point to zero level that extends down to that handle. That being said, the market is going to continue to see a lot of noise in this general vicinity, and if we can break down below the 1.19 level, then it is likely we go looking towards the 200 day EMA.

Without a doubt, it comes down to the interest rate situation in America more than anything else, due to the fact that rising interest rates continues to push the value of the greenback higher. If we break down below this area that we are and right now, we could reach down towards the 1.16 level based upon the longer-term charts and the fact that the next support level is that same place.

If the market does turn around a break above the one point to zero level, then the market is likely to go looking towards the 1.22 handle, which is an area that I think has offered a lot of resistance in the past. The 1.22 level is a significant barrier, and if we can break above there then it is likely that we go looking towards 1.23 level. The market is starting to close at the very bottom of the candlestick, that does in fact suggest that we could make a serious plunge lower. That being said though, the market has been resilient more than once, and there is a general area hear that we are sitting on that could cause quite a bit of noise.

All things been equal, I think that the most likely scenario here is going to be a lot of choppiness more than anything else. This will simply be based upon yields in America more than anything else, and if they do drop at this point, that could send this market right back up. In general, this is a market that will continue to see a lot of noise but that is the normal attitude for this pair. The US dollar has started to turn things around, so we could see a huge market wide appreciation in the greenback which would almost certainly show itself here like everywhere else.