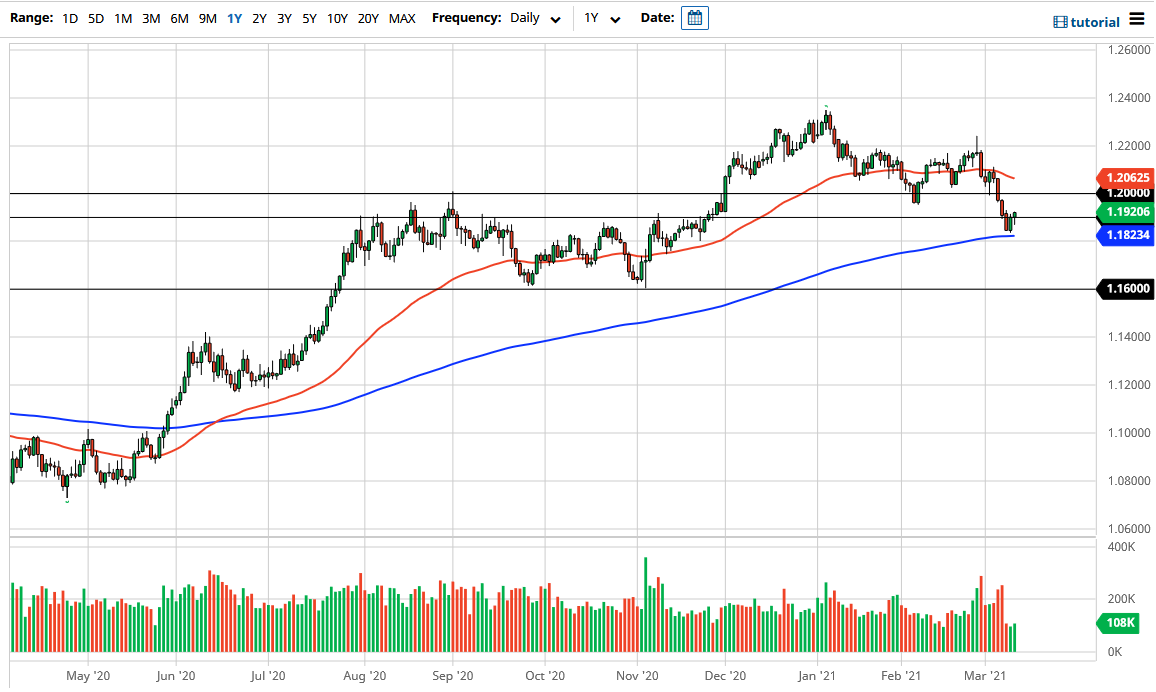

The Euro initially pulled back during the trading session on Wednesday, but then turned around to show signs of life again as we have formed a hammer. The hammer sits just above the 1.19 level, so that of course is crucial and it looks like the market is trying to recover after testing the 200 day EMA over the last couple of trading sessions. This is a market that needed to hang on to the 200 day EMA, or it would have collapsed down towards the 1.16 level.

One of the things that made such a huge difference during the day is the fact that the treasury auctions went really well in America, and that of course drove down yields. Bonds being bought cause lower yields, and therefore the US dollar itself is a little less attractive. That can basically guarantee that the Euro will rally as a result, so that this point in time I believe that the Euro may go looking towards the 1.20 level next. If we can break above the highs of the day that would be my target, as a falling yield in the bond market certainly is a major relief for what we have seen as of late.

When you look at the longer-term charts, the Euro has been rallying rather significantly, and perhaps we got a little bit ahead of ourselves as of late. Because of this, the market is likely in need of this pullback, and now we can see fresh money starting to work. While I am not wildly bullish of the Euro, I can certainly make an argument for why we should at the very least bounce from here. That being said, if we do break above the 1.20 level, then I think we are very likely to continue to go higher, with an eye on the 1.22 level.

Keep in mind that there is positive carry in this pair, so that also helps as people will be looking to take advantage of the “carry trade” as well. Furthermore, French industrial numbers came out during the day much better than anticipated, so that is yet another reason to think that the European Union may be starting to show signs of recovering. Regardless, this is going to be a very noisy market, but I certainly think that it is only a matter of time before we have to make somewhat of an impulsive move.