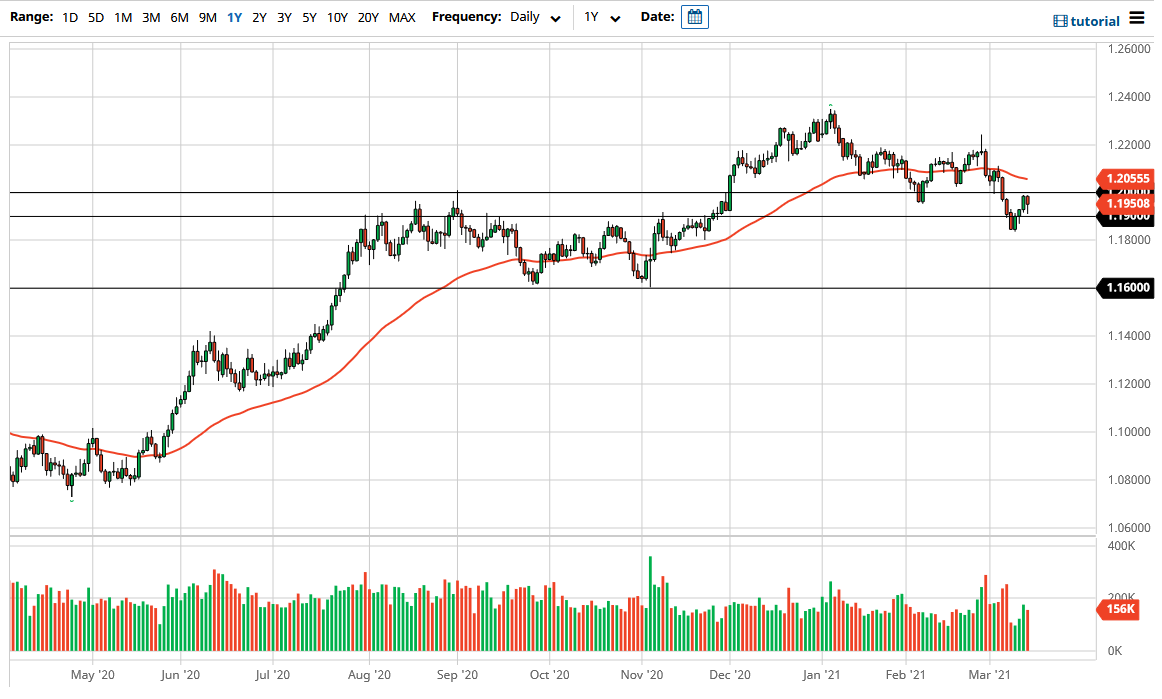

The Euro fell rather significantly during the course of the trading session on Friday, but continues to see the 1.19 level as a place where there would be buyers jumping in. When we look at the shape of the candlestick, it is a bit of a hammer that suggests that there are plenty of buyers underneath. If we can break above the 1.20 level, then it is likely that the market could go looking towards the 50 day EMA above. Breaking above there then would bring in even more money into the Euro, and then could send the market towards the 1.22 level above.

If we were to turn around a break down below the 1.19 level, then we could break down towards the lows earlier in the week. If we were to break down below that candlestick, it would probably send this market looking towards the 1.16 level underneath. I do recognize that the Euro is typically very choppy, and this chart will do nothing to dissuade that thinking. At this point in time, the market would continue to see a lot of noisy behavior, but it certainly looks as if Friday suggests that we are going to go higher.

I do think that given enough time we will see a lot of certainty, but we do not have that right now. The US dollar had recently seen a significant push to the upside, mainly due to the fact that the yields in the United States continue to rise. That tends to send the greenback higher, as it is much more attractive than the Euro. Ultimately, I think that the 10 year yields need to be paid close attention to, and it is also worth noting that Christine Largarde did not explicitly state what type of support the ECB was going to give the markets, and therefore it will have a major influence on the value of the currency as well. I think a lot of traders were trying to front run the ECB flooding the market with more currency than they actually are willing to do. Nonetheless, it looks as if we have pulled back towards a major support level and now it looks like we are trying to turn around and recover. All things being equal, this is a market that I think will be very noisy.