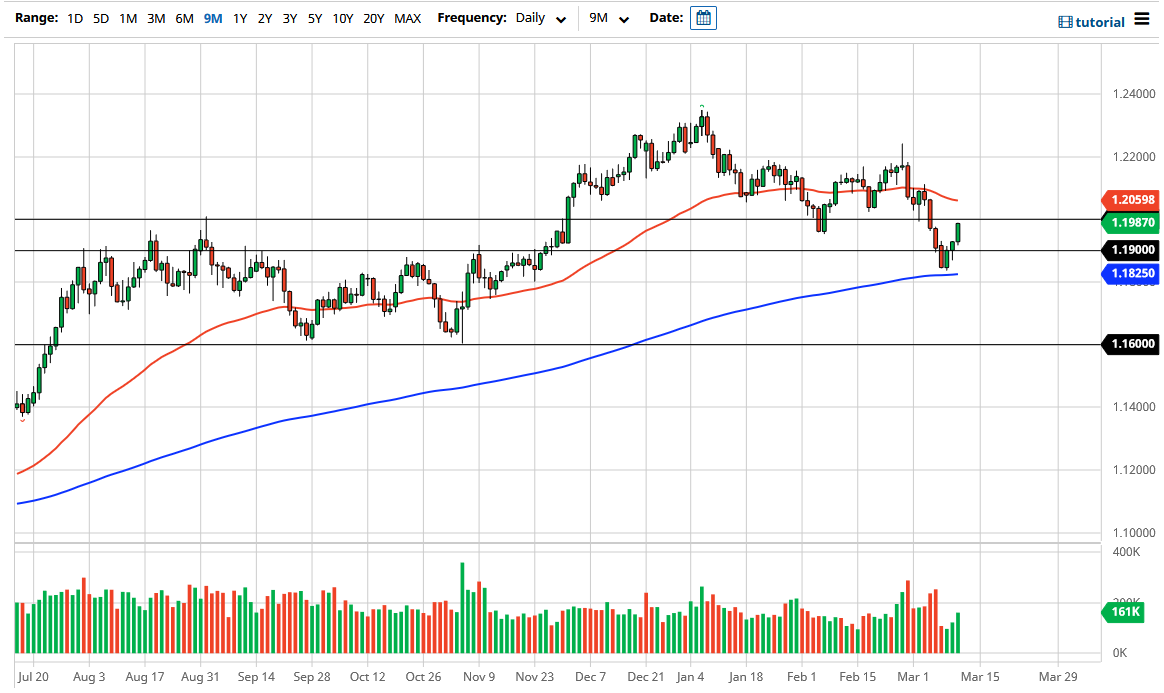

The Euro rallied significantly during the trading session on Thursday after the press conference from the ECB suggests that they are going to print more money, but not necessarily do a lot in a committal way. Because of this, the 200 day EMA underneath being bounced from suggests that we should continue to see the longer-term uptrend, at least in theory. However, when you look at the recent action, we have seen a complete meltdown, followed by a significant bounce. I think that we are going to see more volatility, not less.

With the Americans signing into law a $1.9 trillion stimulus plan, that of course works against the value of the greenback, but at the same time we have seen yields spike occasionally to work against this pair as higher yields in America drive up demand for the US dollar. Recently, it looked as if the 1.20 level is going to be crucial, so if we can close above there on the Friday candlestick, then I think we probably continue to go much higher.

On the other hand, the market breaking down below the 200 day EMA opens up the possibility of a move to the 1.16 handle. I would say that by the end of the day on Thursday it certainly looks more positive than negative, and for what it is worth we have been in a nice uptrend for quite a while. The recent selloff was something that was probably needed, simply because we have been far too stretched.

Ultimately, I do believe that the market will make a bigger move given enough time, and currently it certainly looks as if we are getting back to the “short the US dollar trade”, perhaps due to that stimulus. With the Europeans seemingly not ready to commit to any type of major move or some type of target for stimulus, so ultimately this is a situation where the markets could turn on a dime. That being said, it certainly looks as if we are trying to recover all of those losses and depending on how the Friday candlestick turns out, could end up forming a hammer on the weekly chart. With this, I think that the next 24 hours could be crucial and tell us where we could go for a larger timeframe type of move.