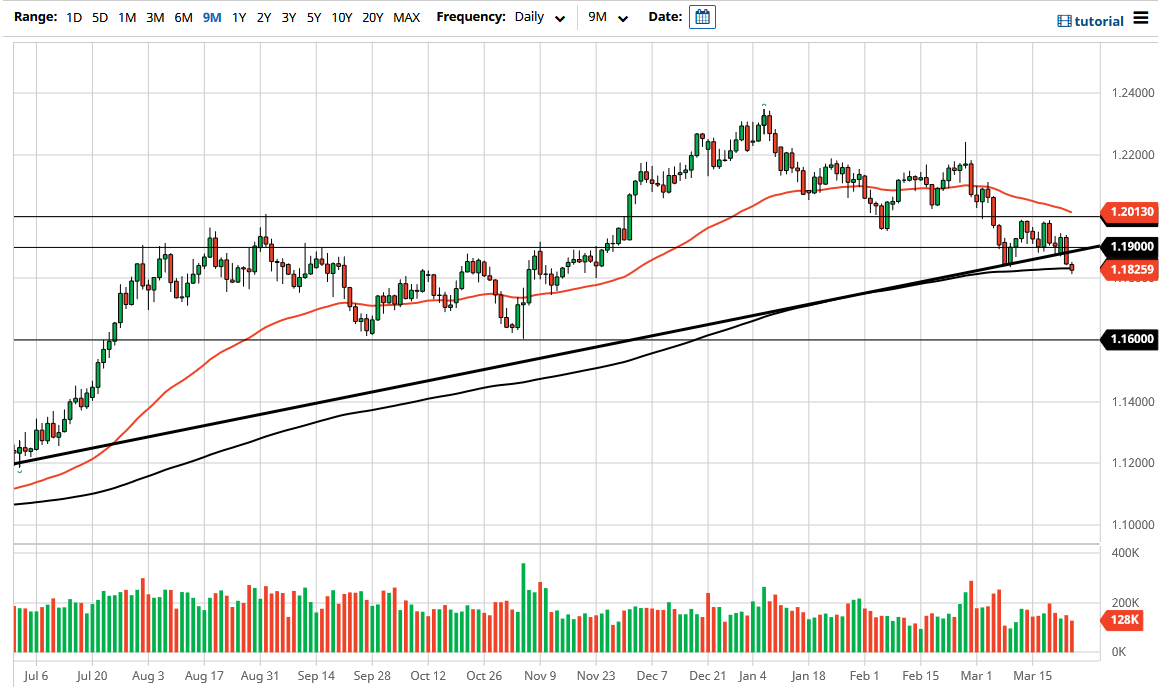

The Euro drifted a little bit during the trading session on Wednesday to reach down towards the 1.18 handle before bouncing ever so slightly. That being the case, it is likely that the market will continue to see the 1.18 level as important, but if we were to break down below there it is likely that we will then go down to the 1.16 handle. Keep in mind that the 200 day EMA is sitting right here as well, and as a result I think what we are looking at here is a longer-term indicator that is causing a bit of technical confusion.

Overall, the US dollar has been strengthening due to higher interest rates coming out the United States, that will more than likely continue to be the case. Furthermore, the European situation when it comes to the coronavirus vaccination is looking quite sluggish, and it is very likely that we will continue to see negativity expressed through the currency. If we break down below the 1.18 level, then I think the move to the 1.16 level would be rather quick. You can also see that we have seen a major trendline broken below, so I think that also adds more of an impetus to further downside pressure.

Another thing to pay close attention to is the fact that German bonds offer a negative yield while treasures in the United States offer a positive yield. That in and of itself can drive this market lower. Whether or not we can get down below the 1.16 level or not is a completely different question, but I do think that would be the target if we see a little bit of negativity. On the other hand, if we turn around in recapture the 1.19 level, it is likely that we could then go to the 1.20 handle, where the 50 day EMA is reaching towards. If you can break above that level, then it could reconfirm an uptrend but right now that seems to be very difficult to imagine, and it clearly looks as if the overall attitude of this market is somewhat negative in general. The candlestick itself was not very negative, but as the fact that it comes after such a negative candlestick on Tuesday that has me thinking more negativity is coming.