The euro fluctuated during the trading session on Wednesday as we see the 50-day EMA now acting as a bit of a magnet. When you look at this EMA you can see that it is relatively flat, so I think we will continue to be somewhat range-bound. We also have to keep in mind that the Friday session is non-farm payroll day, meaning that we will see a lot of choppy behavior and a lack of liquidity at times in the market. Most of the time, when we get these jobs numbers, the market will more than likely go back and forth and essentially accomplish nothing. You will probably see a lot of choppy and erratic trading at best. The day before the non-farm payroll announcement is typically very quiet as well.

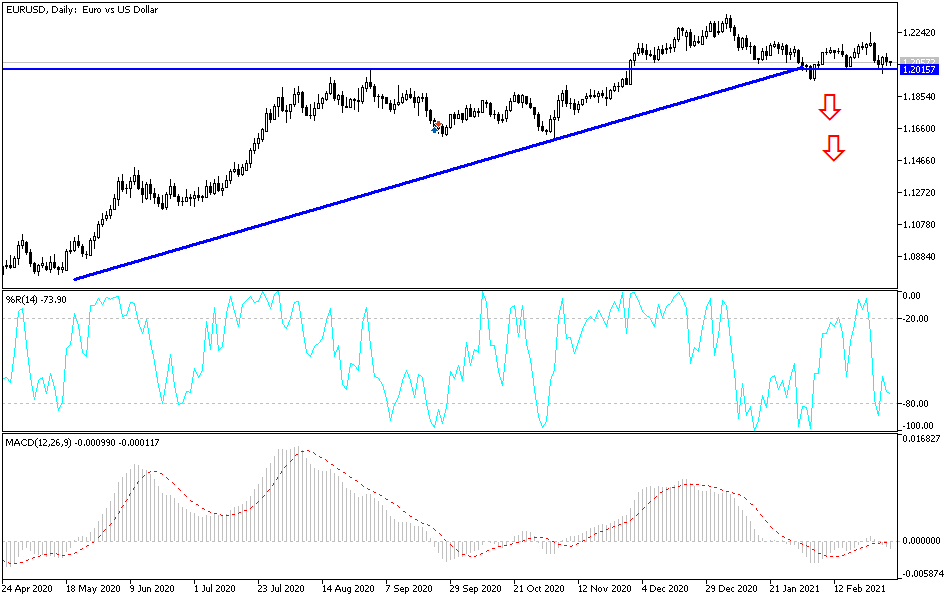

I think this market will continue to hang around in the 1.20-1.22 region, and currently I believe that we are sitting at what I would consider to be “fair value.” To the downside, I believe that the 1.20 level is support extending all the way to the 1.19 handle, so I am not looking for some type of massive breakdown until we get below the 1.19 level. If we do, then I think we will probably open up the doors to a potential move down to 1.16 if things really pick up.

On the other hand, if we were to turn around and break above the 1.22 level, then we could go looking towards the 1.23 level where we had recently seen resistance. At this juncture, I do not expect to see some type of major move, so I think using a simple range-bound system is probably the best way to go, as the market is very undecided and skittish at best. Over the longer term, I do believe that we will see some type of break out and you would have to make the argument that we are in a bit of an uptrend but clearly momentum is starting to wane, and if yields start to spike in the United States that could put upward pressure on the US dollar to drive this pair lower.