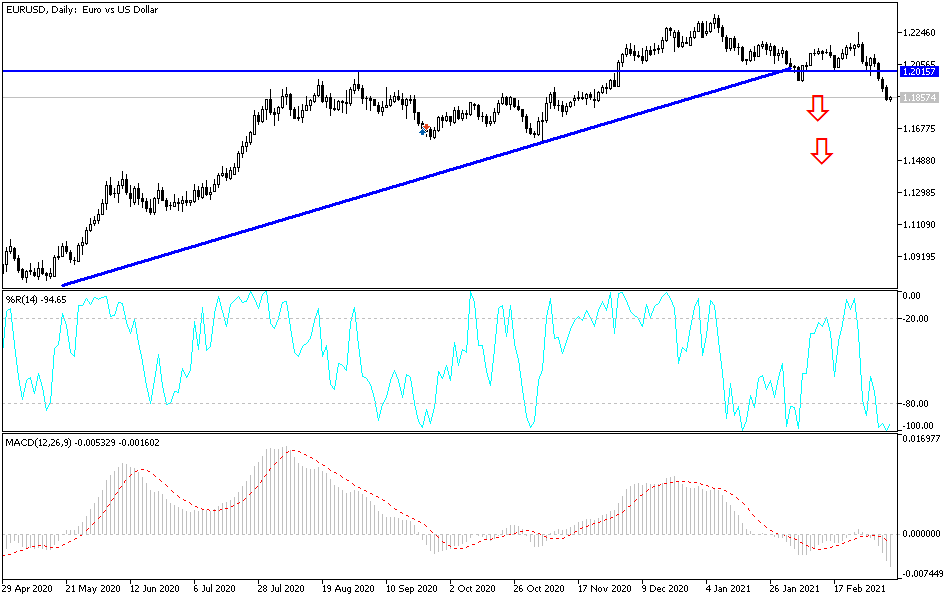

The euro has broken significantly below the 1.19 handle, an area that I thought needed to be protected in order to keep the uptrend intact. The 200-day EMA sits just below and should offer a significant amount of support, but if we break down below there, then it opens up the possibility of a move down to the 1.16 handle after that. One thing is for sure: the 10-year yield has had a major influence on this market, as its strengthening has made the US dollar more attractive.

If we did turn around and take out the top of the candlestick for the trading session on Monday, then it would be a very bullish sign, perhaps sending this market towards the 1.20 level next. That is a large, round, psychologically significant figure, and it could cause quite a bit of trouble. If we do break above there, then the market is likely to go looking towards the 50-day EMA, possibly even the 1.22 handle. That desperately needs the 10-year yield to drop in America to make the euro look a bit more attractive.

Pay close attention to the 1.19 level on the short-term charts, as it could be a catalyst to get involved on some type of exhaustion to continue the overall uptrend, but if we get a daily close above that level that I think it could be a reversal signal. I anticipate that this market will continue to see a lot of volatility regardless, as the US dollar is making waves everywhere. The three candlesticks in a row that are closing towards the bottom certainly does suggest negativity, and it could be thought of as a “modified three black crows pattern.” That is a very negative sign, but at the end of the day we are plowing into major support, so I think there could be quite a few buyers underneath as well. This is a market that continues to be very choppy, but we are starting to see US dollar strength against other currencies as well, so that will clearly be reflected over here. I do not necessarily think that we will break down below the 1.16 level, even if we do break down quite a bit.