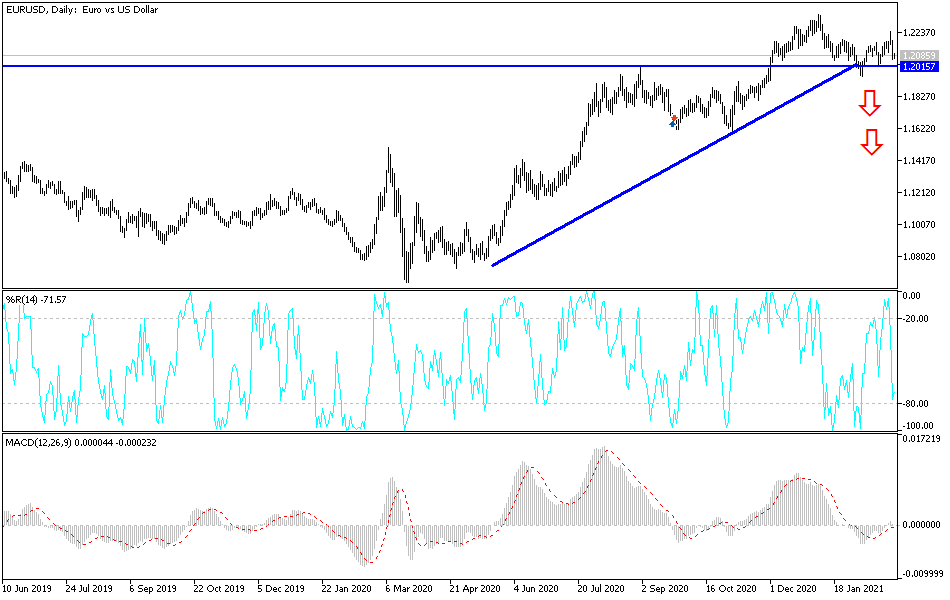

The euro fell rather hard during the course of the trading session on Friday, as we have broken down below the 50-day EMA. By doing so, it does suggest that we could get a bit more weakness, but at the end of the day I think there is plenty of support near the one point to zero level. After all, most of what we are seeing here is in reaction to the yields in America spiking, and that will more than likely be a temporary phenomenon. With that being the case, we will almost certainly find buyers underneath, and the one point to zero level is the most logical place considering what we are seeing from a structural standpoint.

I think at this point we are essentially looking at a market that is going sideways, because it doesn't know what else it could do right now, as there are no real catalysts other than the bond market to push things around. With that in mind, and the fact that the 50-day EMA is flat, I fully anticipate that this is a market that is not going anywhere anytime soon. Bouncing around in this 200-point range makes sense, but even if we do break out, I think that we will only get as high as 1.23 before facing serious headwinds.

The shooting star from the trading session on Thursday was a bit of a “heads up” as to what could happen next, so it is not a huge surprise to see the way things reacted on Friday. It is worth noting that it was the end of the month, so a certain amount of rebalancing in portfolios probably had to happen, and therefore it could have had a bit of a ripple effect into the currency markets. I still believe that the uptrend is fully intact, but obviously we have a few headwinds here and there to deal with. I am thinking more range-bound with an upward bias than anything else when it comes to this market, as that has been its typical attitude over the last several months. At this point, it is only a matter of time before buyers jump back in and trying to reach towards the highs again.