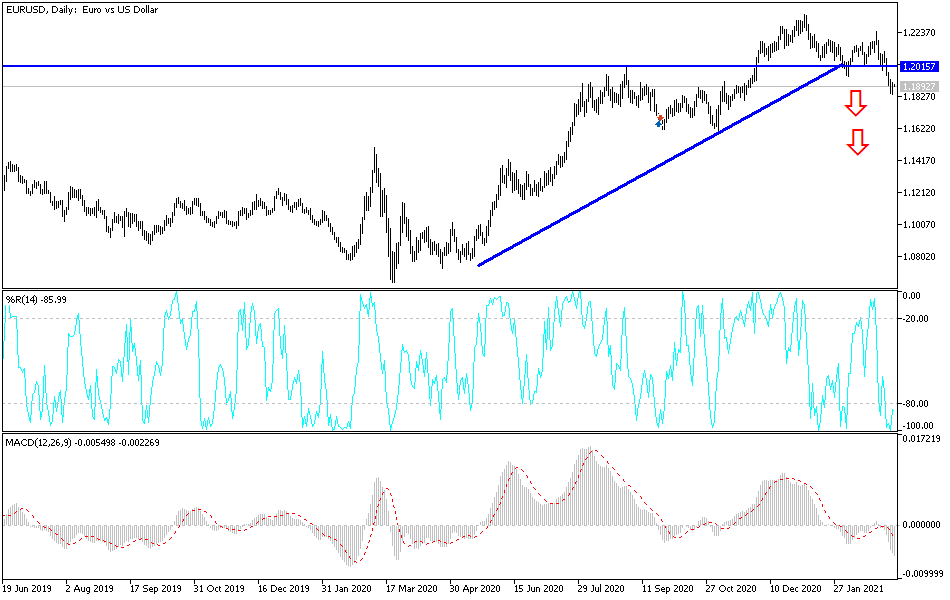

The euro bounced a bit during the trading session on Tuesday as it reached towards the 200-day EMA. This highly followed technical indicator did offer support, and the market reached slightly above the 1.19 level in order to show signs of life again. At this point, the market looks as if it is trying to figure out whether or not it can hold the 200-day EMA, which attracts quite a bit of attention.

It is worth noting that the support level between 1.19 and 1.20 has been sliced through, and it should now in theory offer resistance. It is not until we break above the 1.20 level that I would be comfortable buying this market, but I also recognize that the 10-year yield needs to be paid close attention to in America, because that has been a major driver of where the US dollar has been moving anyway. Keep in mind that the US dollar is half of the equation, so if we see a little bit of exhaustion in the greenback, that can also help this market rally again.

On the other hand, if we see the yields in America strengthen again, that makes the US dollar much more attractive and would probably send this market looking towards the 200-day EMA, and then eventually lower than that given enough time. By breaking below the 200-day EMA, we could then go down towards the 1.16 level rather quickly. Because of this, I do think that we are going to see a significant move sooner rather than later. We have gotten a bit oversold in the short term regardless, so a bounce is probably to be expected. The question now is whether or not we can turn around a break above the 1.20 level. If we can, that would be a very bullish sign. The one thing you can probably count on over the next several sessions will be a lot of noisy trading, so that is something that you will probably have to keep in the back of your mind, and you should probably keep your position size relatively small until we get some type of conviction when it comes to the move, and then you can start adding to your underlying core position.