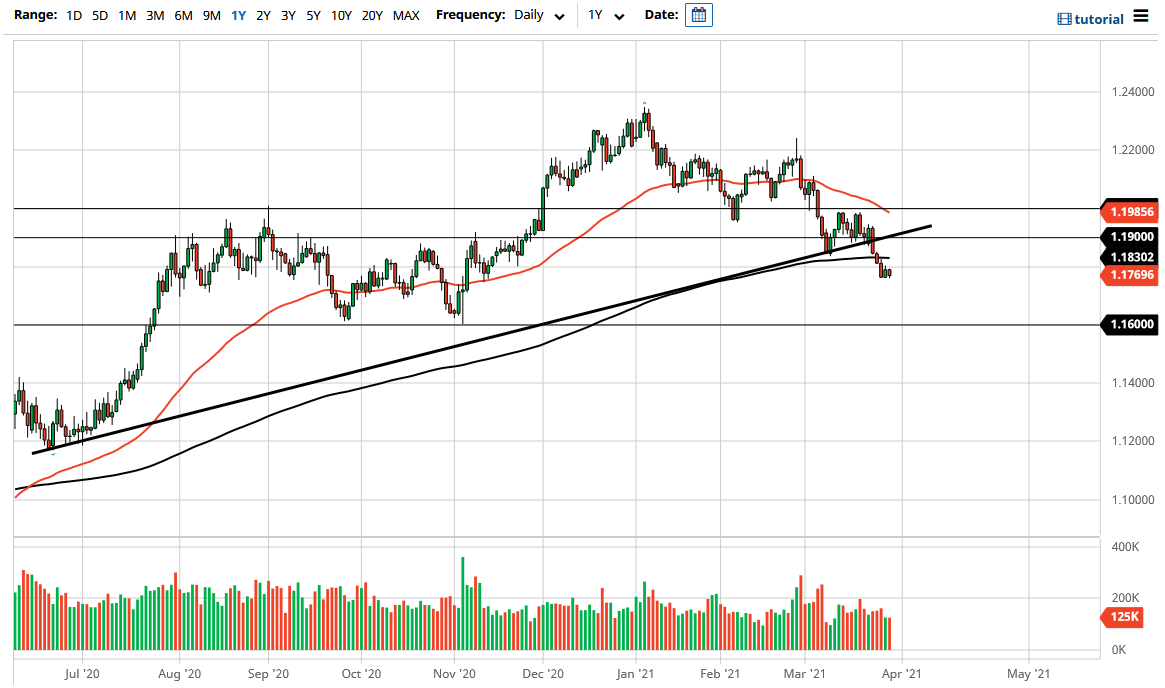

The Euro has fallen a bit during the course of the trading session on Monday as we continue to see the US dollar strengthened overall. With that being the case, I think that if we break down below the lows over the last three days, this pair probably drops rather significantly, perhaps reaching down towards the 1.16 level. That is an area where we see a significant amount of support but breaking through there would be an absolute disaster for the Euro and send this pair much lower.

Do not get me wrong, even though I do believe that we go down to the 1.16 handle, it may take some time to get there. We are just below the 200 day EMA, which of course has a certain amount of influence on how the market behaves as well. With that being the case, I think that the market will eventually have to make a decision, and I would anticipate that there should be the occasional selling opportunity as we get closer to the 200 day EMA. On the other hand, if we were to break above that level, that could change the overall attitude of the market.

Having said all of that, even a breakout above the 200 day EMA still has you thinking a lot of different questions because we had broken through a major trendline. The trend line in theory should be resistance on the way back up so I would anticipate some issues there. Breaking above that trendline then would confirm a move towards the upside again, but in the meantime, I think what we are looking at is a scenario where we will just fade rallies that show signs of exhaustion. This is especially true considering that the US continues to lead the world when it comes to recovery and vaccinations on the whole. With that being the case, and of course the fact that the European Union continues to struggle vaccinating it is citizens and dealing with the lock down situation, it makes quite a bit of sense that we would continue to go lower over the longer term. Whether or not we can break down below 1.16 is a completely different question, but it certainly looks as if we are going to try to find out over the next several weeks.