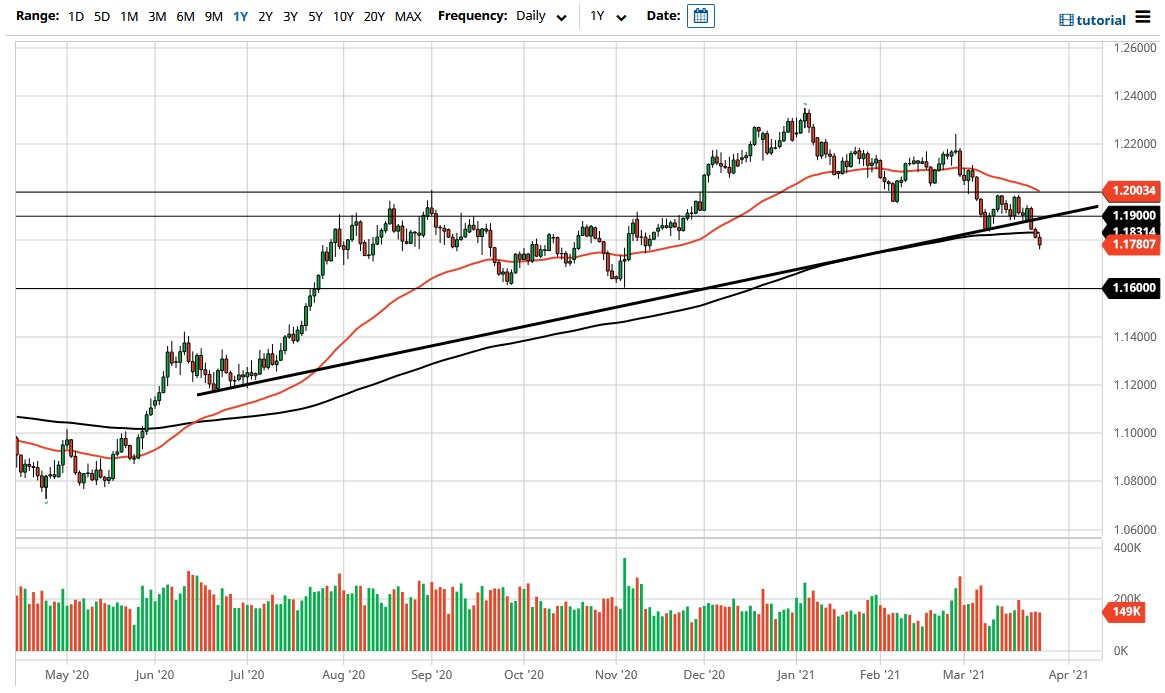

The Euro continues to struggle overall as we have seen a lot of US dollar positivity. After all, when you look at the yields in America, it does make quite a bit of sense that we would see a continuation of the move lower. At this point, I believe that the Euro is breaking significant support and is likely to go looking towards the 1.16 level. That being said, short-term rallies are to be sold from what I can see, and therefore I have no interest in trying to get long.

Another thing to pay close attention to is the lack of vaccinations in the European Union, so it does continue to weigh upon this currency. The differential in bond yields continues to favor the greenback, and I think that will be the main driver for the short term. We recently had broken above an uptrend line, and that in and of itself will have a certain amount of attention paid to it. After that, we broke through a 200 day EMA, and that of course makes this a potential bearish move in the making.

If we were to break down below the 1.16 handle, that could drop this market down towards the 1.15 handle rather quickly as it is a large, round, psychologically significant figure that a lot of people would be paying close attention to.

On the other hand, if we were to turn around a break above the uptrend line, then it is likely that the market could go to the 1.20 level after that. The 50 day EMA sits right at that same level, so if we were to break above there, then I think a lot of longer term traders will get back involved in this market to the upside and reach towards the 1.22 handle. Breaking above there then opens up a move towards the highs again, but all things been equal, this is most certainly a nasty move to the downside that looks like it has plenty of momentum and interest, so I most certainly think that the market is likely to continue lower, all things being equal. The odd certainly favors that move, so I am much more aggressive to the downside on short-term charts to take advantage of the attitude change that we have seen in the greenback overall, and of course the fact that the European Union has so many other issues makes this a trend of the making.