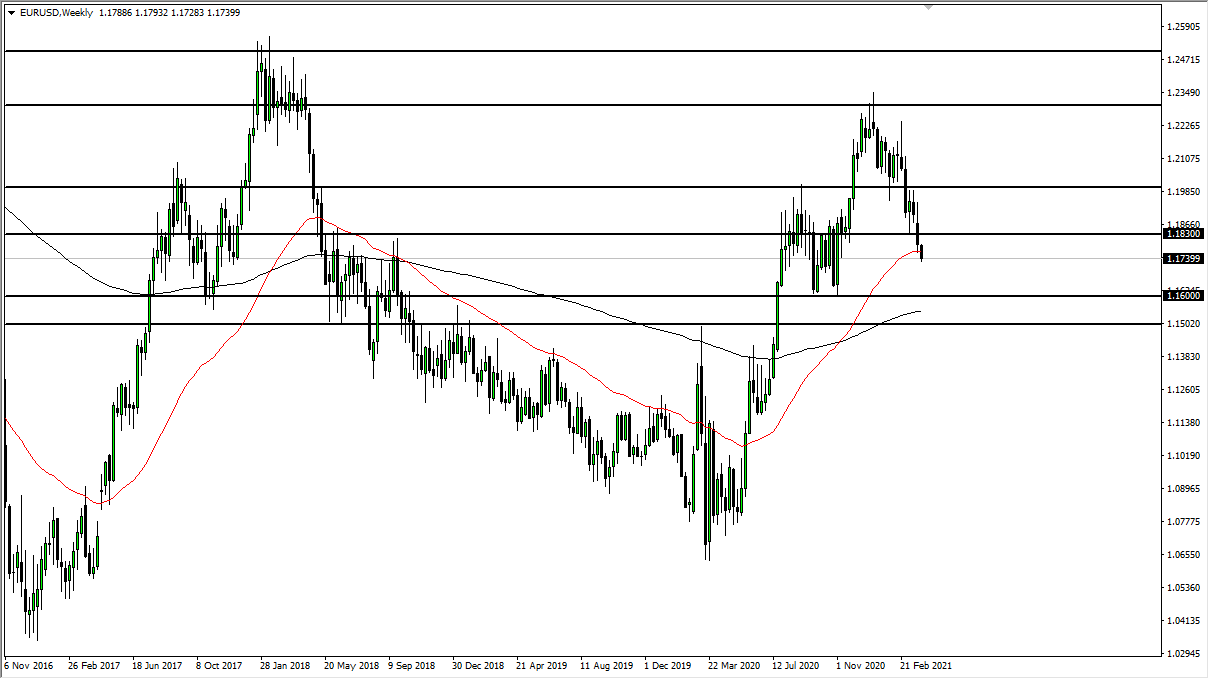

The Euro has seen a serious drop during the month of March, and it looks very likely to continue into the month of April, at least initially. The real support level underneath that I see is somewhere around the 1.16 level. That area has been supportive as of last summer, and it certainly should at least have a bit of “market memory” attached to it. I also anticipate that the market is likely to see a bit of support extending down to the 1.15 level, so I would think of this more or less as a “zone of support.”

While I do not necessarily think that we are going to break down below the 1.15 handle, if we did that would be an extraordinarily bearish turn of events, possibly kicking off a multi-month selling of the Euro. As things stand right now, I anticipate that we will see the Euro drift down to the support level and then bounced just a bit. This market is moving based upon a couple of different factors at the moment, both of which will not be solved right away.

For example, one of the biggest drivers in my estimation is the lack of efficiency when it comes to vaccinations in the European Union. As I write this, the European Union is going through its third wave of coronavirus, and at the same time seemingly cannot pull it together enough to vaccinate the masses. Simultaneously, we have seen the interest rates in the United States spike quite a bit, and I think that is going to continue to be the case, at least for the short term. However, once we get to the 2% level on the 10 year note, it is very likely that we will not be able to see yields go further. If they do, obviously it would be a major problem for markets but at that point I suspect that the Euro would get a little bit of a reprieve.

That being said, you need to pay close attention to the 1.15 level, because if the market does break down below there, then we could be looking at a move down to the 1.12 level. The market is likely to continue to see a lot of back and forth and noisy behavior but certainly favors the downside more than anything else for the beginning part of the month.