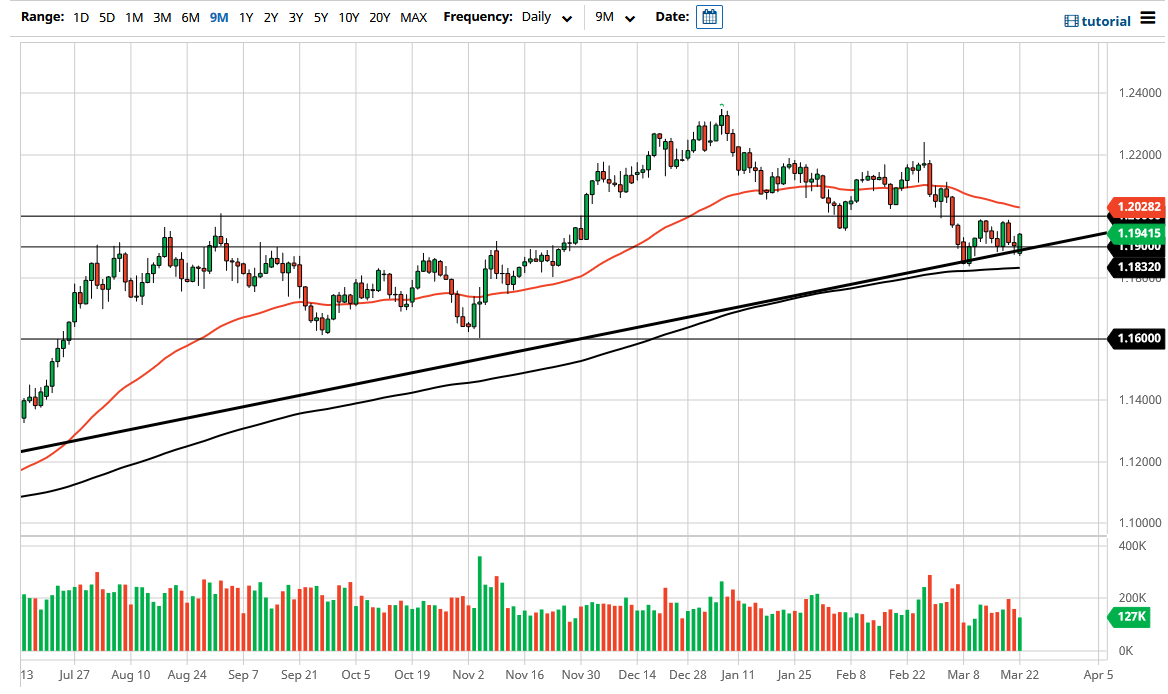

The Euro has bounced from the crucial support level based upon an uptrend line and of course the round figure of 1.19 just below. Ultimately, this is a market that is still essentially stuck between the 50 day EMA and the 200 day EMA indicators, which means that we do not necessarily have anywhere to be in the short term. However, the next couple of days could set up for some volatility as Jerome Powell testifies in front of the U.S. Congress over the next couple of days.

Not only do we have an uptrend line underneath, but we also have the 200 day EMA which recently has offered support. That being said, the 50 day EMA is just above the one point to zero level so there has been a little bit of a “squeeze” in the market. I do not necessarily think that we are ready to go anywhere quite yet, at least not until we get some type of catalyst. One of the most important things that we have been paying attention to as of late has been interest rates in America, because as if they rise, it makes the US dollar much more attractive. However, interest rates did drop a bit during the trading session on Monday so that has helped the situation.

The other part of the equation to worry about is the coronavirus vaccination rates. This is where the European Union has really dropped the ball, so if that starts to be focused on again, that will almost certainly work against the value of the Euro. At this point though, I think the market is simply trying to figure out where to go next, and in the short term it is very likely to be very choppy more than anything else. However, as the week plays out, we may finally get a little bit of momentum.

You could make a small argument for an ascending triangle trying to form, but I think that might be stretching it a bit. In general, I am paying close attention to the 10 year yields, because if they start to rally again that will almost certainly work in the US dollar’s favor. A breakdown below the 200 day EMA opens up the possibility of a move down to the 1.16 handle. I would not put huge positions in this market anytime soon though, at least not until we get that impulsive move I am looking for.