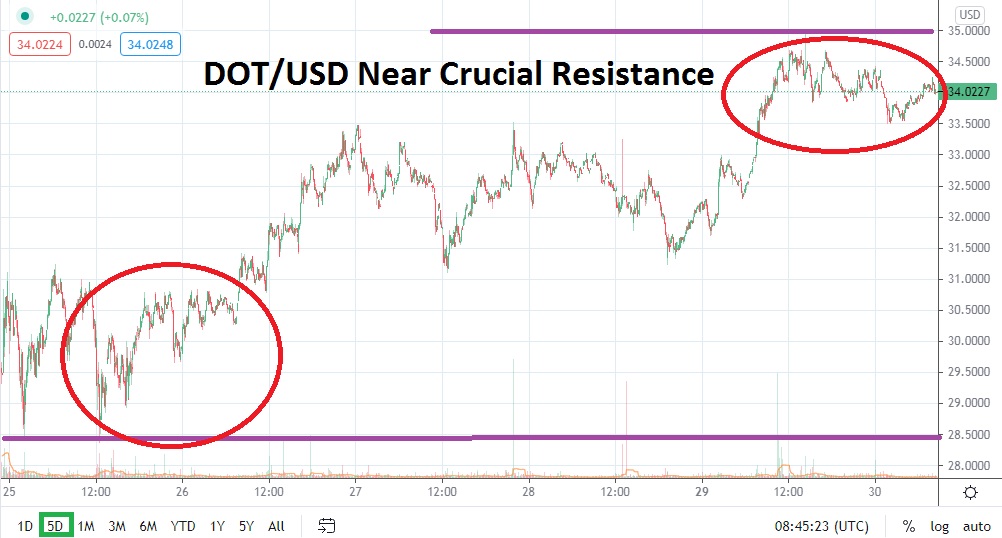

In early trading this morning, DOT/USD is trading within sight of the 35.0000 mark as it actually traverses closer to the 34.0000 level below. This is important because the 35.0000 value above appears to be an important inflection point for trading sentiment within Polkadot. If the 35.0000 resistance level proves vulnerable, speculators will certainly target higher values knowing DOT/USD spent plenty of time in March trading between 35.0000 and 39.0000.

On the 20th of March, DOT/USD touched the 40.0000 juncture which put it within sight of highs made on the 20th of February, which saw Polkadot touch the 42.0000 value for a brief moment. The broad cryptocurrency market has shown positive sentiment the past handful of days, and to highlight the potential for swift moves within Polkadot, traders should understand that DOT/USD hit 36.0000 on the 24th of March and suddenly saw a spike downwards which took it towards the 28.0000 mark, but this is not the end of the story.

Since hitting this lower value only one week ago, DOT/USD has incrementally been able to demonstrate staying power and move higher. Support levels have risen and Polkadot has been able to correlate well with its major cryptocurrency counterparts and is now challenging important resistance. If the 35.0000 mark proves vulnerable, speculators will certainly believe higher values are potential targets.

DOT/USD remains a speculative playground for traders. The cryptocurrency produces swift trading and speculators need to anticipate volatility by using limit orders to protect against rather awkward price fills. However, the ability of DOT/USD to trade within a technical correlation with the larger cryptocurrency market serves to underscore the asset can prove to be a worthwhile wager.

Technical traders should look at five-day charts and notice the ability of DOT/USD to exhibit higher values and incrementally raise support levels. From the 19th of February until the 24th of March, DOT/USD has been able to produce a trading range above its current values.

Taking into consideration the positive sentiment buzzing through the broad cryptocurrency market short term, DOT/USD appears to be a potential buying opportunity. Cautious traders may want to wait for slight pullbacks in value to launch their buying positions. If a speculator wants to be aggressive in today’s market they cannot be blamed, but they should use stop losses to protect against the potential of sudden spikes downward if they want to pursue upward momentum and the bullish sentiment which is within the cryptocurrency market now.

Polkadot Short-Term Outlook:

Current Resistance: 35.0000

Current Support: 33.5300

High Target: 36.2100

Low Target: 31.2300