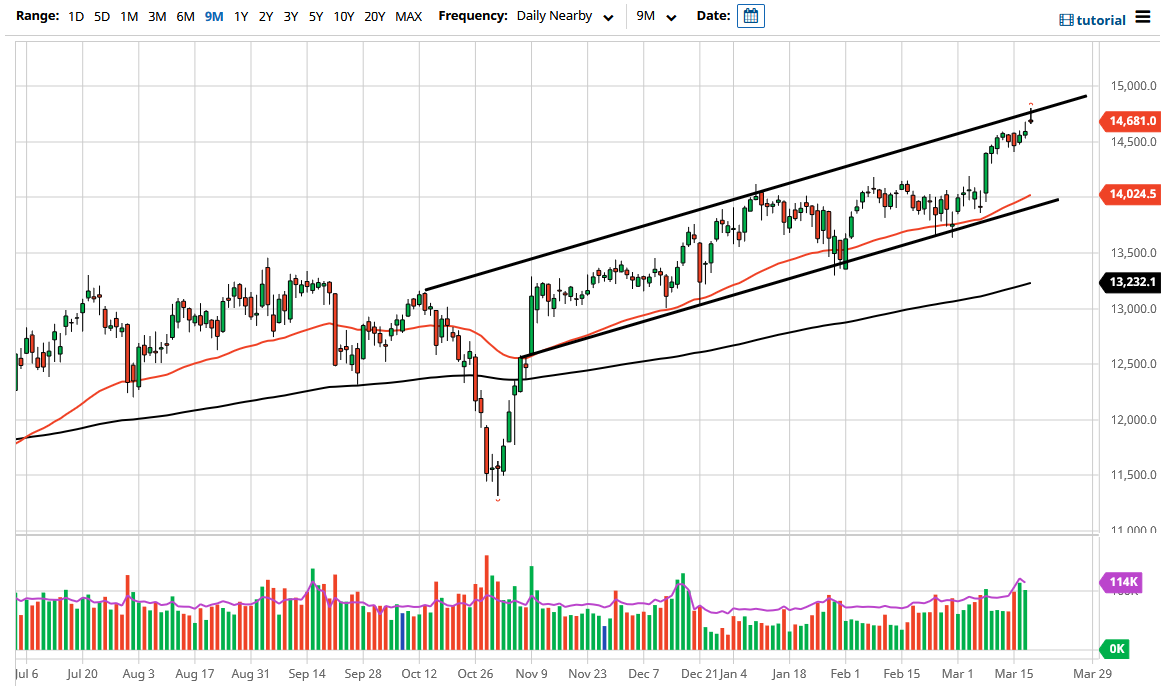

The DAX gapped higher to kick off the trading session on Thursday and then shot straight up in the air. It ended up banging up against the top of the overall channel that we have been in before it gave back the gains. It is all about the bond markets now, which continued to sell off drastically on inflation fears. This offers more yield for paper, and therefore people like the idea of owning yield over risk assets such as stocks. With that being the case, I think what we are seeing here is a market that has gotten ahead of itself.

Keep in mind that this comes down to the overall “reopening trade”, but the DAX got hit due to the fact that a lot of people are concerned about Europe opening up. After all, the vaccination situation in Europe has been nothing short of abysmal, as it seems like the government cannot quite get the logistics down. The market participants will continue to look at the idea of whether or not there will be a lot of demand for industrial components coming out of Germany. While Germany is a major exporting country, most of its exports either go to China or the European Union, with much of the EU struggling to keep its economy working.

From a technical analysis standpoint, I think there is still plenty of support underneath, especially near the 14,500 level, so I do anticipate that this market is simply pulling back from a slightly exaggerated move. In general, I would anticipate that the market is going to go looking towards that level as a potential buying opportunity, but if we break down below that region, we could open up a move down towards the 14,258 level. Nonetheless, stock markets had gotten a little frothy and that will be the case in Germany just as it is in other places like the United States. If we were to break out above the top of the shooting star, then it could open up a move towards the 15,000 level above.

I think the only thing you can count on at this point is volatility, and there is also a strong possibility that the gap underneath will probably be filled first thing in the day. The question is whether or not we can turn around.