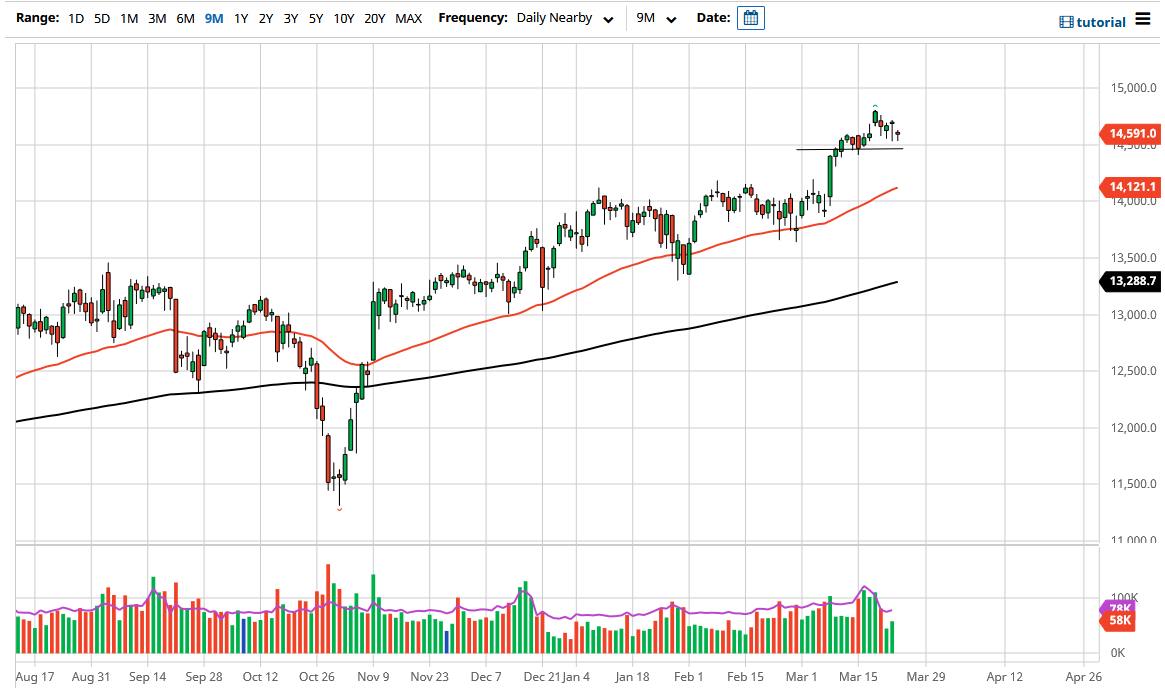

The German index gapped lower to kick off the trading session on Wednesday but turned around to show signs of strength. The candlestick of course is a hammer, and that is a very bullish sign. The 14,500 level underneath has been supportive multiple times now, so I do think it is only a matter of time before we show signs of bullish pressure to the upside. The 14,500 level has been extraordinarily important over the last couple of weeks, after the recent break out to the upside from the 14,250 level.

Looking at this chart, I believe that what we are seeing is an attempt to finally make it to the 15,000 handle. This is a bit surprising, considering that Germany is in the midst of another wave of coronavirus, and of course the significant amount of local lockdowns works against the strength of the German economy, but most traders are out there overlooking the short term concern for the idea of the reopening trade. With that being the case, the DAX is almost destined to go to the 15,000 handle.

One of the thing to pay close attention to is the fact that we have formed several hammers in a row, and it does suggest that we are going to continue to go higher. This of course does suggest that we would probably have plenty of interest in trying to get involved on the short-term dips. However, if we did break down below the 15,500 level, it is likely that we could go down to the 50 day EMA, which is a technical indicator that so many different people will pay attention to. It is sitting just above the 14,000 level, which is a significant area of support from what we have seen previously as well, so I do think that would be the “floor in the market” that should continue to be important. In fact, I suspect that if we pull back to that area there will be even more buyers willing to get involved.

I have no interest whatsoever in shorting this market and therefore I will simply look for buying opportunities based upon a supportive candlestick, or some type of impulsive bullish candlestick that shows further buying pressure. If we can break above the 15,000 level, then it becomes more of a “buy-and-hold” type of situation.