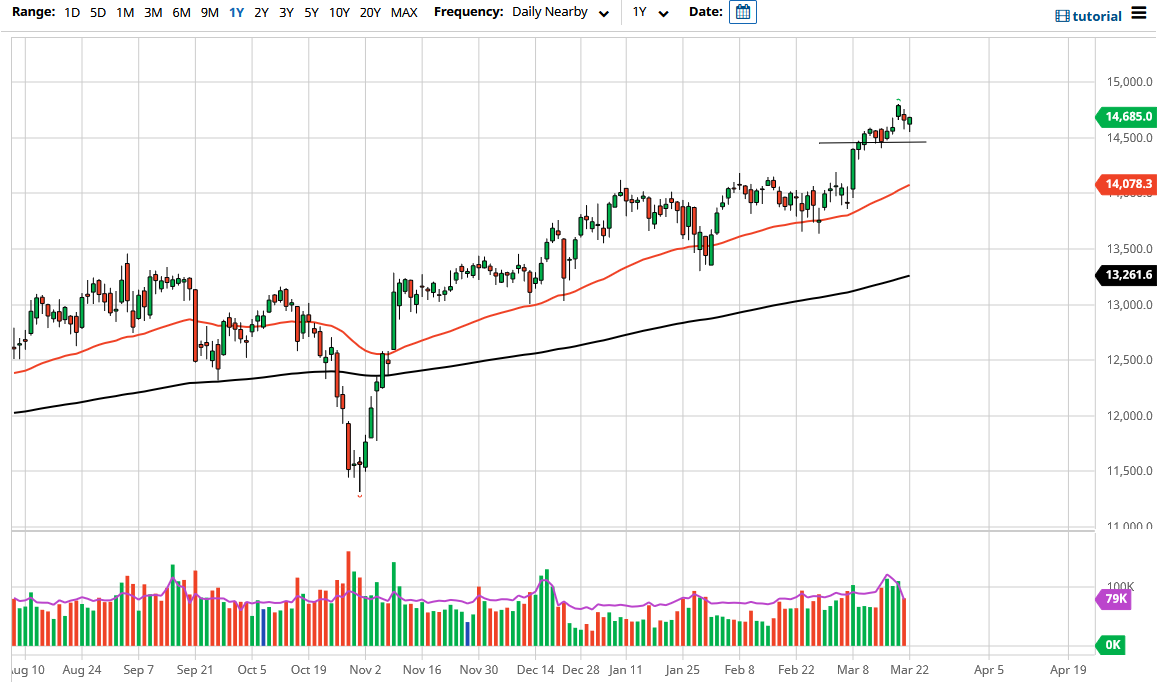

The German index fell initially during the trading session on Monday as all indices did, only to turn around and show signs of strength again. The gap from last week has been filled and now I think it is probably a matter of time before we go to the upside. We close that the very top of the range so that is a very bullish sign, and it is likely that we are going to continue to go higher from here. If we do, then the 15,000 level is an area that I would be very interested in, as I think it will be a nice target. In fact, 15,000 has been my target for some time and while the European Central Bank continues to flood the markets with liquidity, and have even threatened by even more bonds, it makes sense that stock markets will continue to rally as a result.

Underneath, the 14,500 level has been supportive over the last couple weeks, so certainly that is an area that you need to pay attention to. If we were to break down below that level, then I think it is likely that we will go looking towards the 50 day EMA which is just above the 14,000 handle. Notice how I did not say anything about shorting this market, because quite frankly there is no reason to think that we should do that. We are in a strong uptrend, so there is no point in trying to fight it at this juncture. After all, if we have a loose central bank and the possibility of a reopening trade around the world, Germany will continue to provide a lot of other countries with industrial goods which is a huge portion of the DAX itself.

If we can break above the 15,000 level, then I think we go looking towards 15,500 next as the DAX does tend to move in 500 point ranges. Longer-term, I do not know where we go but clearly the overall proclivity of this market is to the upside so there is no point in trying to fight it. This is a marketplace that I think continues to find plenty of buyers every time we dip and as a result, I think it is a pretty straightforward set up that we have in Germany at the moment.