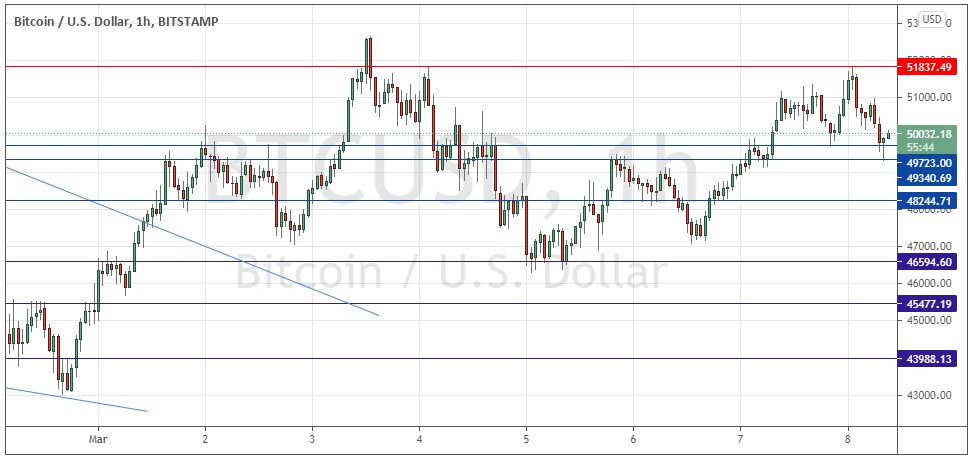

Last Wednesday’s Bitcoin signals were not triggered, as the bearish price action after the resistance level occurred above $51,837 after that level was first reached.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken before 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $49,340, $48,245, or $46,595.

- Place the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $51,837 or $55,146.

- Place the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that the technical picture had become clearly bullish, with the price clearing $50k with firm bullish momentum. However, I thought that the resistance level at $51,837 looked convincing and might be hard to break. Therefore, I was looking for a short trade which may have set up if we saw a failure at $51,837 but I wanted to see some strong bearish momentum for an hour two before any such entry, with the price below $50k. I was also considering a long trade after two hours above $51,837 and that was a good call as after breaking above the level it came right back down straight away, so this was enough to keep out of trouble.

The technical picture is still bullish but weakly so, with the key resistance level at $51,837 holding again very precisely and generating a bearish inflection point. However, the price was previously grinding higher and producing narrowly spaced higher stairstep support points, none of which have yet been broken.

I think the best scenario to wait for here is still going to be a bullish breakout above $51,837. Two consecutive hourly closes above that level later today will give me a bullish bias up to at least the next higher resistance level at $55,146.

There is also the possibility still of a short trade from a potential bearish failure at $51,837 but I think that would not run as well as a bullish breakout would, so it would probably be an inferior trade entry opportunity.

Market sentiment is somewhat mixed so its not clear how sentiment is going to affect Bitcoin this week. There is nothing of high importance scheduled today concerning the USD.

There is nothing of high importance scheduled today concerning the USD.