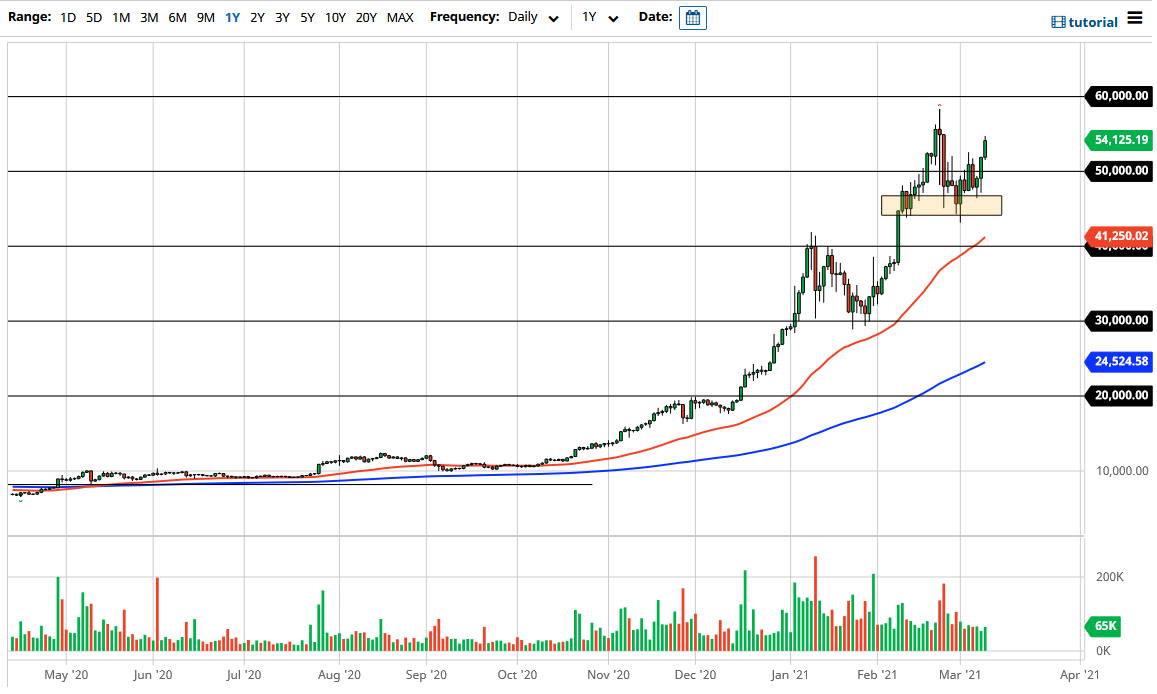

The Bitcoin market has broken out above the recent resistance to reach towards the $54,000 level. The $54,000 level in and of itself does not mean much, but what is worth paying attention to is that the market has broken short-term resistance. With that being the case, it is very likely that we will continue to see a lot of buying pressure, especially as traders have been looking for some type of momentum to get involved again. The area around the $58,000 level has also offered quite a bit of resistance, so it would not be surprising at all to see Bitcoin struggle a bit in that general vicinity.

I do think that a lot of Bitcoin traders are aiming for the $60,000 level, and the influx of institutional money will continue to drive this market to the upside overall. The candlestick for the trading session on Tuesday does suggest that we are going to continue to see buyers, and I think at this point we are likely to look at short-term dips as potential buying opportunities. I believe that the $50,000 level will more than likely continue to offer support as well. Given enough time, we will look at that $50,000 level as a bit of a magnet for price, and therefore could offer a bit of a “floor in the market.”

Even if we were to break down below the $50,000 level, the $45,000 level has proven itself to be crucial, and I suspect that any pullback towards that area will probably run into the 50-day EMA, reaching towards that area as well. For what it is worth, the 10-year yields in America did drop during the trading session, so that also weakened the US dollar. That has an effect as money goes into the cryptocurrency markets; not only Bitcoin, but other ones such as Cardano and Ethereum. Crypto itself is going higher in general, and it is a trend that you should not be fighting.

Yes, we may have to do a bit of work to continue going higher based upon the parabolic nature of the rally, but you clearly cannot be a seller under any circumstances, and I would not even look at that possibility until we break down below the $40,000 level at the absolute minimum.