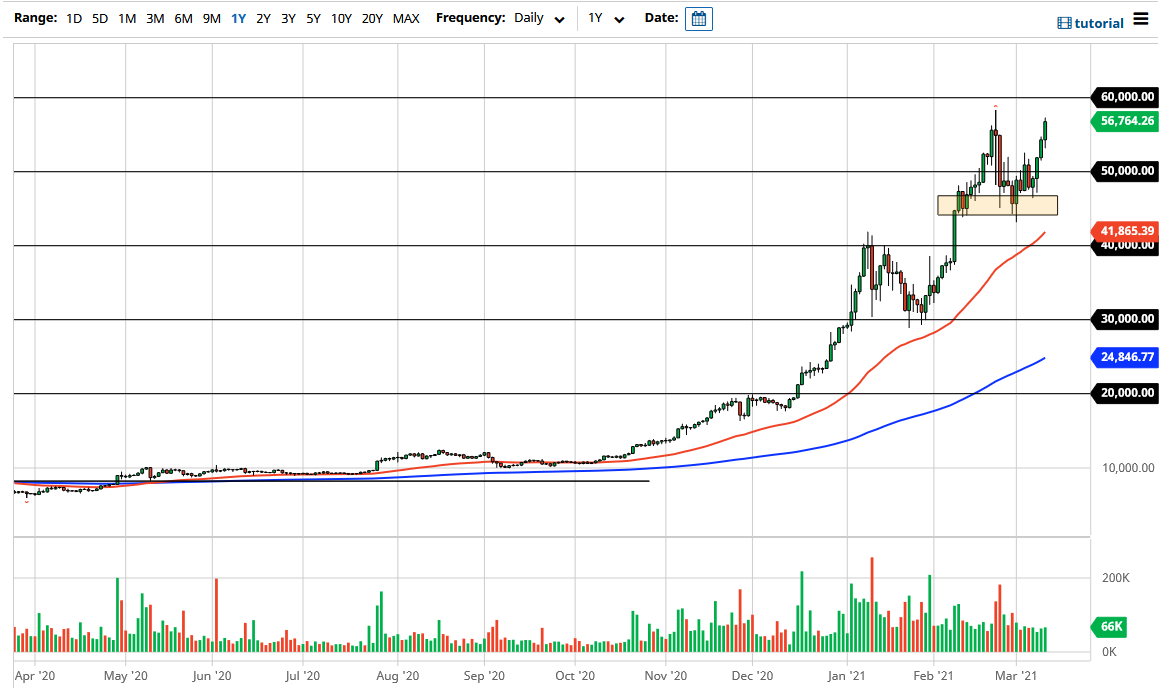

The Bitcoin market initially pulled back just a bit during the trading session on Wednesday but then turned around to show signs of strength yet again. Ultimately, the market is threatening a massive candlestick that formed the all-time high just a few weeks ago, and now it looks like we are primed to go looking towards the $60,000 level. That being said, we have rallied rather significantly over just the last three sessions, so this suggests that maybe we could get a short-term pullback. I would look at the pullback as a potential buying opportunity because I do believe that it is only a matter of time before we try to reach that $60,000 level.

Underneath, the $50,000 level should be important for support, and therefore I think that we could see quite a bit of buying pressure underneath, as we have seen a lot of buyers between that level and the $45,000 handle. Ultimately, this is a market that I think continues to find plenty of reasons to go higher, not the least of which is that fiat currencies are going to be printed as quick as possible over the next couple of years.

During the trading session, the US treasury had a very strong treasury auction, driving yields down. That did make the US dollar less attractive, so with the chart you are looking at, the BTC/USD pair, it makes sense that it would take more of those greenbacks in order to buy one Bitcoin. This is a simple situation where one of the two currencies are getting hammered, and therefore even though we have seen strength in the greenback the past couple of weeks, it is still at extremely low levels.

At this point, I do not really have any interest in trying to short this market, nor what I suggest that it would be very easy to do anyway. The $40,000 level should be a massive support level that people will be paying close attention to, and it is not until we break down below there that I would be concerned about the overall uptrend. With that in mind, I believe that a lot of traders will be more than willing to jump into this market and “buy on the dips.” If we break above the $60,000 level, then it is a bit murky as to where we go next.