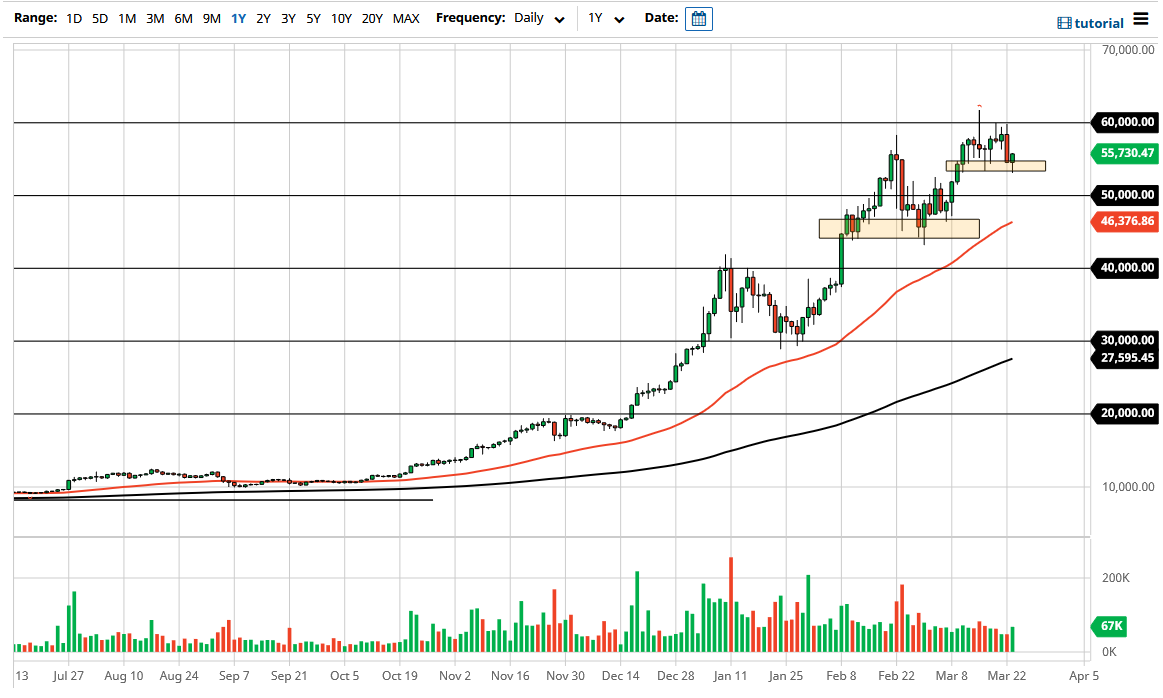

Bitcoin markets have initially fallen during the trading session on Tuesday but turned around to form a bit of a hammer. This of course is a very bullish candlestick, and therefore it makes quite a bit of sense that it should only encourage some type of rebound. Ultimately, this is a market that I think is in an uptrend, and therefore you should look at bullish candlesticks with interest, as it should be a continuation of what we have seen over the last several months.

The fact that we formed a hammer sitting at roughly $55,000 is something worth paying attention to, because it tells me that the market is still looking to go to the upside and is still interested in the $60,000 level above. The $60,000 level is of course an area that will attract a lot of attention because it has been so resistive of the last couple of weeks, which of course will make it a bit of a target. If we can break above there, then it is likely that we will break another $5000 higher, due to the fact that we are in a $5000 consolidation area right now anyway.

On the other hand, if we do pull back, I think that there is plenty of support near the $50,000 level, which is a large, round, psychologically significant figure and an area that has seen a lot of short-term action. After that, then we have the $45,000 level which I think is going to be your short-term “floor the market.” Not only is that an area where we have seen a lot of buying recently, but we have also seen the 50 day EMA cross above that level, so I think there are a couple of different reasons to think that we will continue to go much higher. At this point, the market is one that you simply cannot short, as we have seen so much in the way of bullish momentum, and of course crypto currency in general has done quite well. We have seen this across the entire sector with ADA, VET, and several other coins that I follow. The US dollar has gained during the day, so this shows that there is real strength in the crypto universe right now, because it can continue to go higher in the face of war dollar demand.