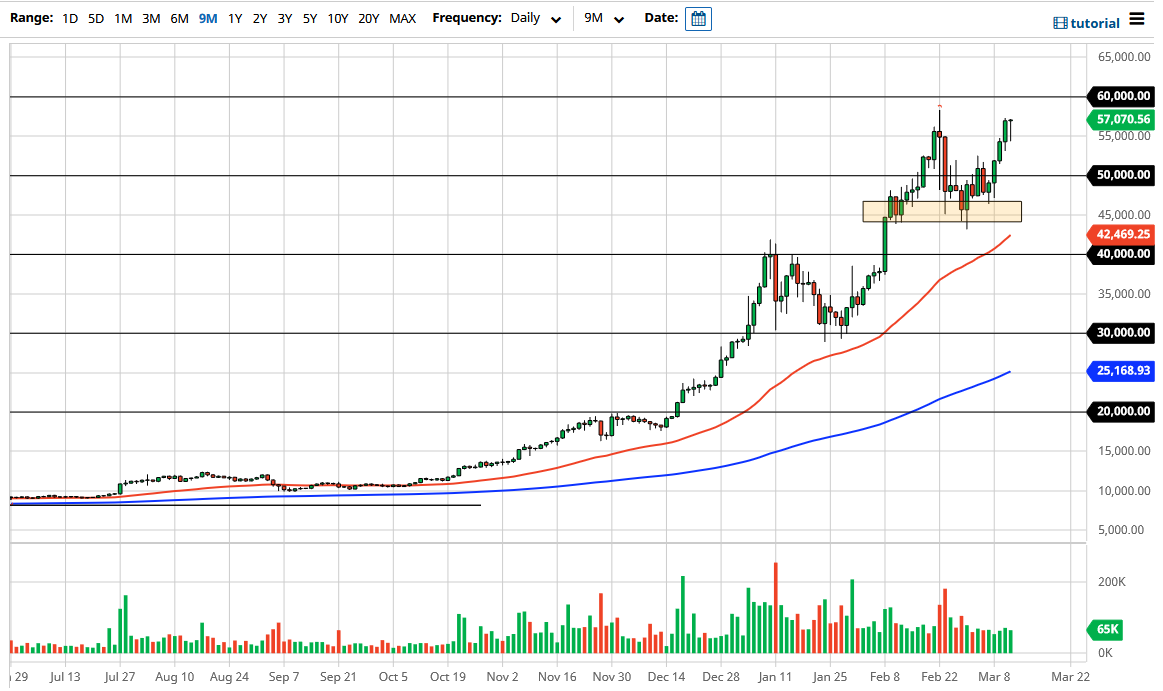

The bitcoin market initially fell significantly during the trading session on Thursday, but as you can see has turned around to show signs of strength again. This shows that money is flowing into the market, and not just in the bitcoin market, but crypto in general. Having said that, as I look at charts such as VeChain, Cardano, and others, there are buyers coming in on that dip. This is of course led by bitcoin, so it makes sense that we are seeing everything at the same across-the-board.

The yields in the 10 year note have dropped in America, so that has put downward pressure on the US dollar, and at this point in time it is starting to show its face in the crypto currency markets as well. As traders are trying to get away from fiat currencies in general, obviously the US dollar is by far the biggest one. Furthermore, when you can look at the market from the last several months, you will notice that every time we pull back the buyers have come into the market to pick things up. At this point, it looks like the $60,000 level will be the short term prize.

Looking at the daily candlestick, it is a bit of a hammer, but if we break down below the bottom of range, then we could see the candlestick turn into a “hanging man.” That of course is a negative sign but I would not be too concerned about it due to the fact that there are multiple support levels underneath that would more than likely attract a lot of inflow. The most obvious one of course would be the $50,000 level, and then after that we have the $45,000 level which is also backed up by the 50 day EMA rather quickly.

As long as we can see this market stay above the 50 day EMA, the job of the bitcoin trader is to simply pick up short-term dips in order to take advantage of value when it appears. All things been equal, I do not have any interest in trying to short this market, because there is a ton of money that is trying to jump into the marketplace, and that continues to offer plenty of support at multiple points in time.