Last Thursday’s AUD/USD signals may have produced a losing short trade from the bearish price action at 0.7804.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered prior to 5pm Tokyo time Friday.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7811, 0.7839, or 0.7884.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7739 or 0.7697.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

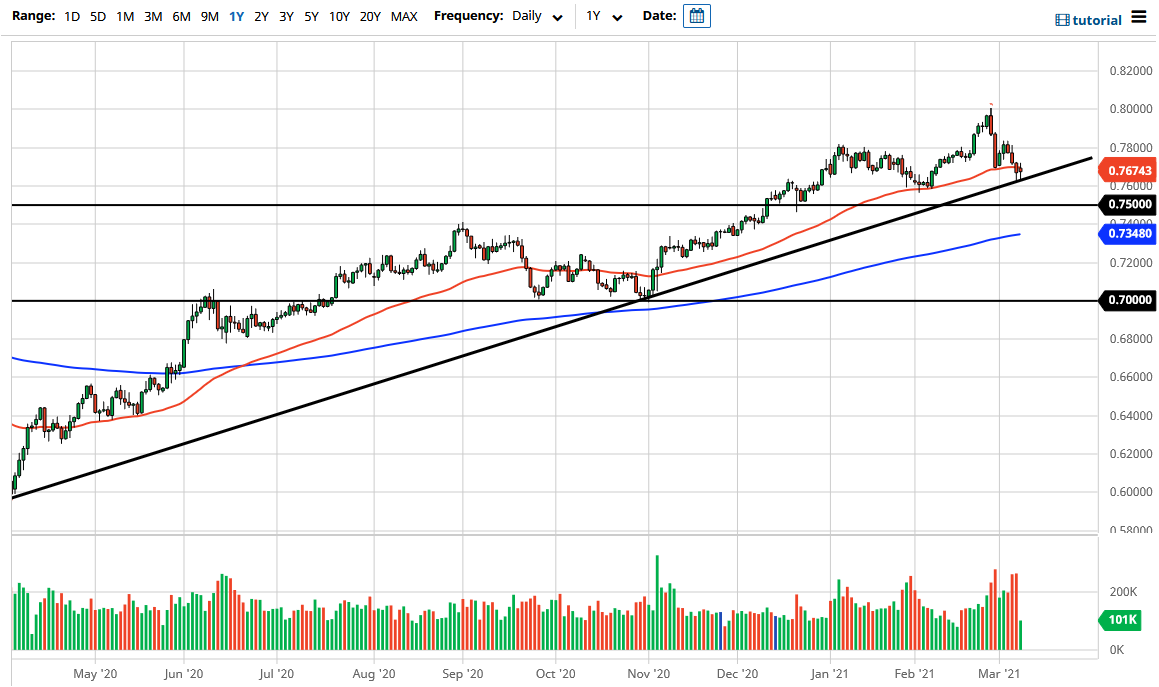

I wrote last Thursday that the technical picture was one of consolidation between 0.7750 and 0.7839. Therefore, I saw the best approach to trading this currency pair as being prepared to trade reversals from either support or resistance levels, provided such trades were managed on short time frames.

I was ready to take a long trade from a bullish bounce at 0.7739 or a short trade from a bearish bounce at 0.7839. However, neither trade set up and the price action was more bearish than I had predicted.

The price has continued to decline over recent days due to a strong advance by the U.S. dollar rather than specific weakness in the AUD. However, we are seeing initial signs of a bullish double bottom formation getting printed from the area of support which begins below the current price at 0.7624.

Despite the short-term bullishness, bulls face hurdles at 0.7729 and of course the big quarter-number at 0.7750, so the upside may well be limited here. These levels can be used as barometers to judge bullishness as a sustained break above 0.7750 today will likely be a bullish sign and suggest a continued rise to 0.7811 if it sets up.

There is nothing of high importance scheduled today concerning the USD. Regarding the AUD, the Governor of the Reserve Bank of Australia will be giving a minor speech at 10pm London time today.