Bearish View

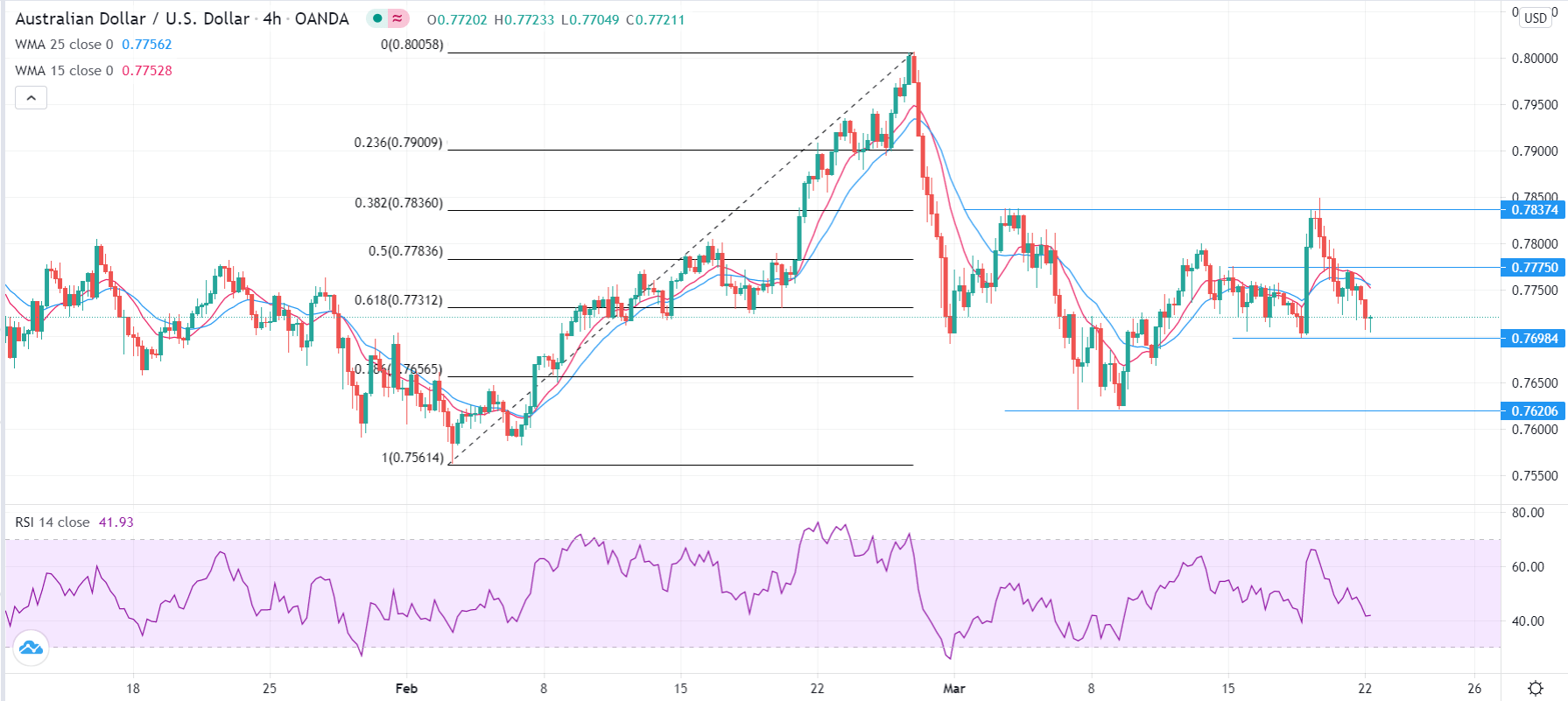

Set a sell-stop at 0.7700 (last week’s low).

Add a take-profit at 0.7620 and a stop loss at 0.7775.

Bullish View

Set a buy stop at 0.7775 (Thursday high).

Add a take-profit at 0.7837 and stop-loss at 0.7700.

The AUD/USD is under pressure in early trading as the market reacts to the recent meeting between the US and Chinese representatives in Alaska and the falling oil prices. The market is also focusing on the overall strong US dollar.

China and US meeting

China is the most important Australian trade partner. The country buys most of Australia’s goods like copper and iron ore, and services like education and tourism. In the past few years, many Chinese have moved and invested in Australia.

Therefore, the market was following the recent talks between Chinese and American officials in Alaska. The two countries are trying to move past the confrontation that happened during the Trump administration.

However, the two sides confronted each other on key issues and failed to address potential issues like tariffs. Biden’s administration has refused to remove the tariffs that were implemented during the previous administration.

The rising tensions between the two countries could have negative implications for the AUD/USD. For one, it could affect the sentiment of commodities and the Chinese economy. Indeed, most commodities like iron ore and copper declined sharply today.

Meanwhile, the pair is also reacting to the bond market where Australian and US bond yields have cooled slightly. The 10-year US bond yield has declined to 1.682% while that of Australia has fallen to 1.761%.

AUD/USD Technical Outlook

The four-hour chart shows that the AUD/USD recently formed a double top pattern at 0.7837. In technical analyses, this is usually a bearish move. Indeed, the price has dropped by more than 1.63% from the upper side of the double-top.

The 25-day and 15-day weighted moving averages have made a bearish crossover while the price has moved slightly below the 61.8% Fibonacci retracement level.

Oscillators like the Relative Strength Index (RSI), Stochastic, and the Relative Vigor Index (RVI) have also declined, which is a sign that bears are prevailing.

Therefore, in the near term, the pair may continue dropping as bears target the March low at 0.7620. To do this, they will need to move below the important support at 0.7698.

On the flip side, a rise above 0.7775 will invalidate this trend because it will send a signal that there are still bulls left to push the price higher.