Bearish Case

Set a sell-stop at 0.7600 (psychological level).

Add a take-profit at 0.7550 and stop-loss at 0.7680.

Timeline: 1-2 days.

Bullish Case

Set a buy stop at 0.7663 (today’s high).

Add a take-profit at 0.7750 and a stop loss at 0.7600.

The AUD/USD price is under pressure as investors turn to the safety of the greenback and as commodity prices struggle. It is trading at 0.7635, which is slightly above last week’s low of 0.7562.

Rush to Safety

The AUD/USD is struggling because of the overall strong US dollar as investors rush to safety as global risks rise. The US Dollar Index has risen by 0.10% and is close to its highest level in more than three months.

This trend is mostly because of the overall rising US bond yields as the markets brace for higher inflation and interest rates. Still, in his testimony last week, Jerome Powell insisted that the bank will not hike interest rates or unwind its massive quantitative easing program any time soon.

Meanwhile, the AUD/USD is falling because of the Chinese economy and the struggling commodity prices. The prices of most commodities like copper, iron ore, aluminum and zinc have declined recently. This is partly because the Chinese government has scaled down its spending as the country recovers from the pandemic.

Last year, the country’s copper imports rose by 34% while cobalt rose by 45%. This spending helped push their prices to a multi-year high. Now with the purchases fading, the Australian dollar could be vulnerable because it is often viewed as a proxy for commodities.

There will be no economic release from Australia and the US today. Therefore, the market will focus on the key events that are scheduled for this week like global Manufacturing and Services PMIs, Australian retail sales, and US non-farm payroll numbers. Also, the AUD/USD will react to a three-day lockdown in Queensland in a bid to curb the virus. This will affect the country’s tourism and hospitality sector in an important Easter week.

AUD/USD Technical Outlook

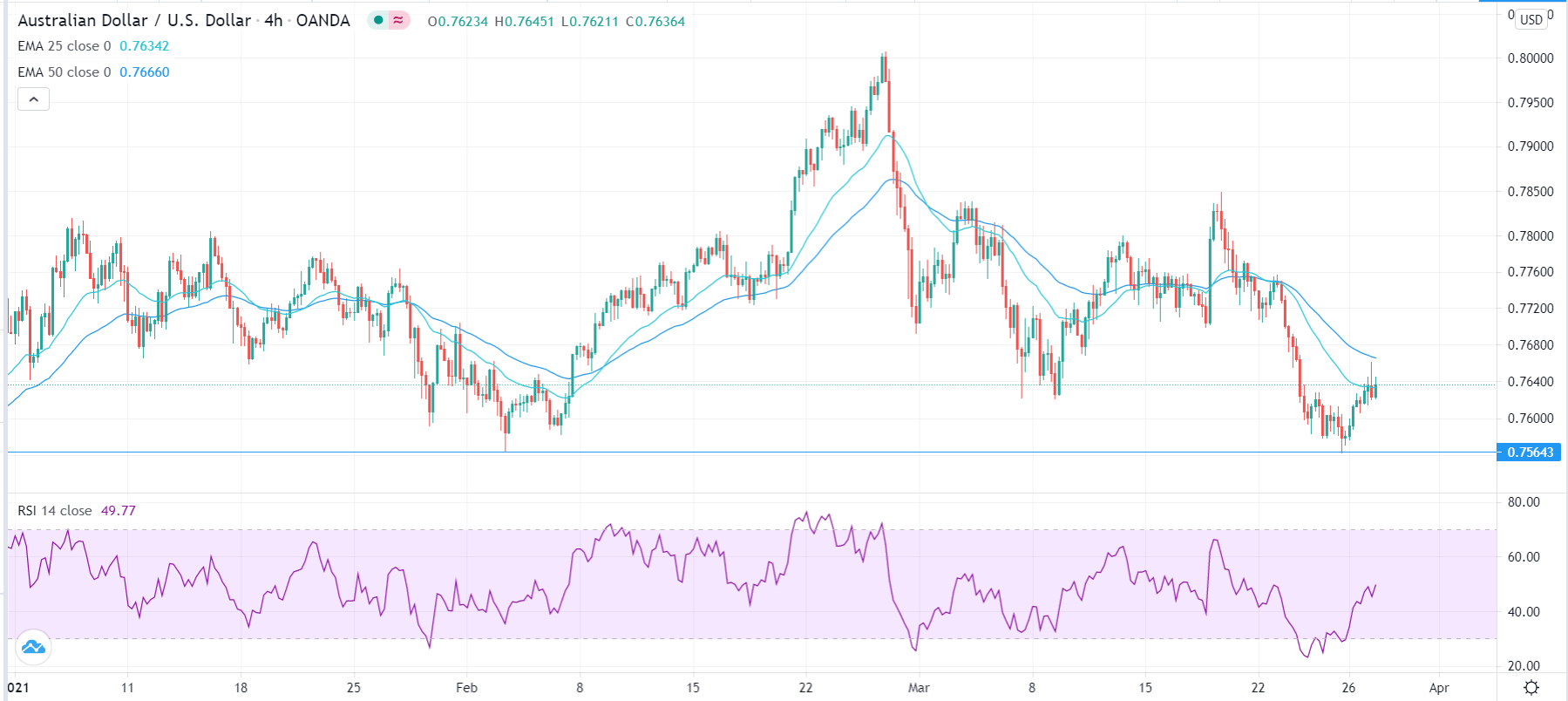

Last week, the AUD/USD pair declined to 0.7564, which was the lowest level since February 2. It is trading at 0.7636, which is slightly above last week’s low. Also, the price is slightly below the 25-day and 15-day exponential moving averages (EMA) while the Relative Strength Index (RSI) has moved from the oversold level of 23 to the current 50. The pair may resume the downward trend as investors attempt to move below last week’s low of 0.7564. However, any move above 0.7680 will invalidate this trend.