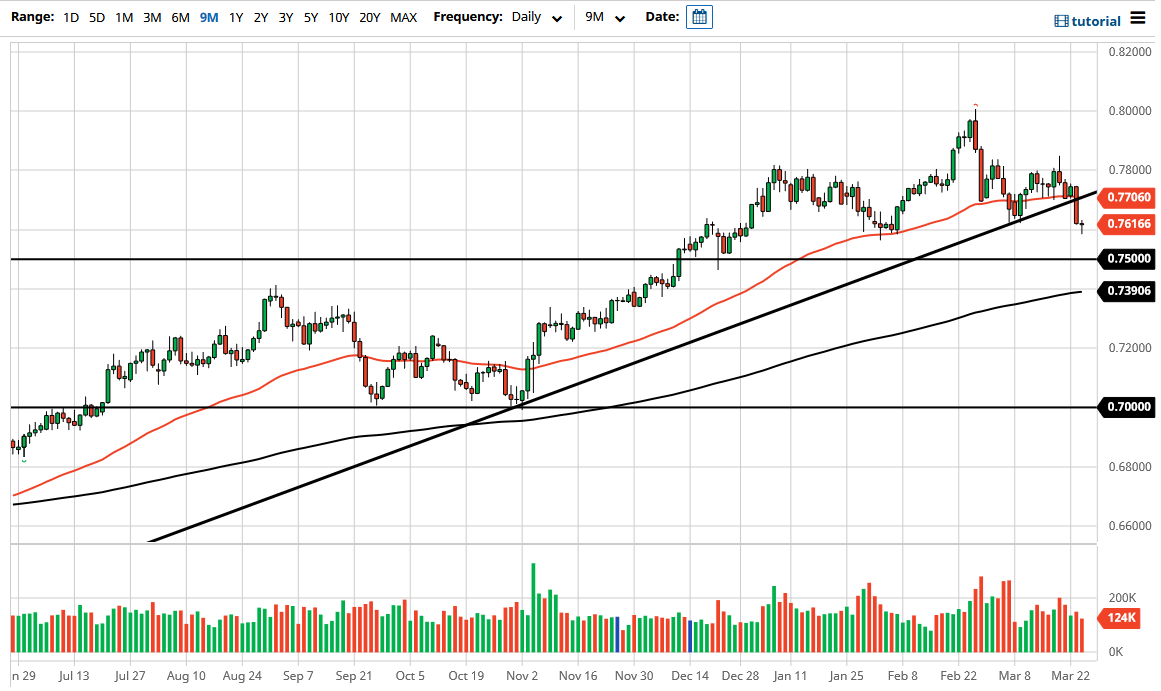

The Australian dollar has fallen a bit during the trading session on Wednesday to reach down below the 0.76 level before turning around and showing signs of support. Having said that, the massive candlestick that formed on Tuesday shows such negativity, and I think that a short-term rally probably shows signs of exhaustion to start selling again. On the other hand, if we break down below the candlestick, then it is a selling opportunity as well.

The reason I am looking at the market like this is the fact that we have formed a massive shooting star for the month of February, and that of course is something that you should pay close attention to. If we break down below the bottom of the candlestick for the trading session on Wednesday, it could break this market down towards the 0.72 level in theory, perhaps even lower than that. I do recognize that the Australian dollar is a market that has been extraordinarily strong for several months, and as a result a pullback would make quite a bit of sense. Furthermore, the 0.80 level above is a major resistance barrier that extends to the 0.81 handle. We have failed at that level, and it is worth noting that the most recent strong candles have all been red. That tells you that the market is starting to change its overall attitude.

Rallies at this point would probably be ignored by me, unless of course we were to wipe out the massive candlestick from Tuesday. If we did that, then it could shows significant strength, but I would like to see that in and impulsive candlestick. If we just grind higher, I think it is only a matter of time before we would see sellers come back in, because we need some type of major attitude shift in order to see some type of bigger move.

Keep in mind that the Australian dollar is going to move back and forth with the idea of commodities being in more demand, but the economy globally is going to be very noisy, so people will start to question whether or not we are going to show a lot of demand for those hard assets. The reality is that we probably will, but a lot of that has already been priced in.