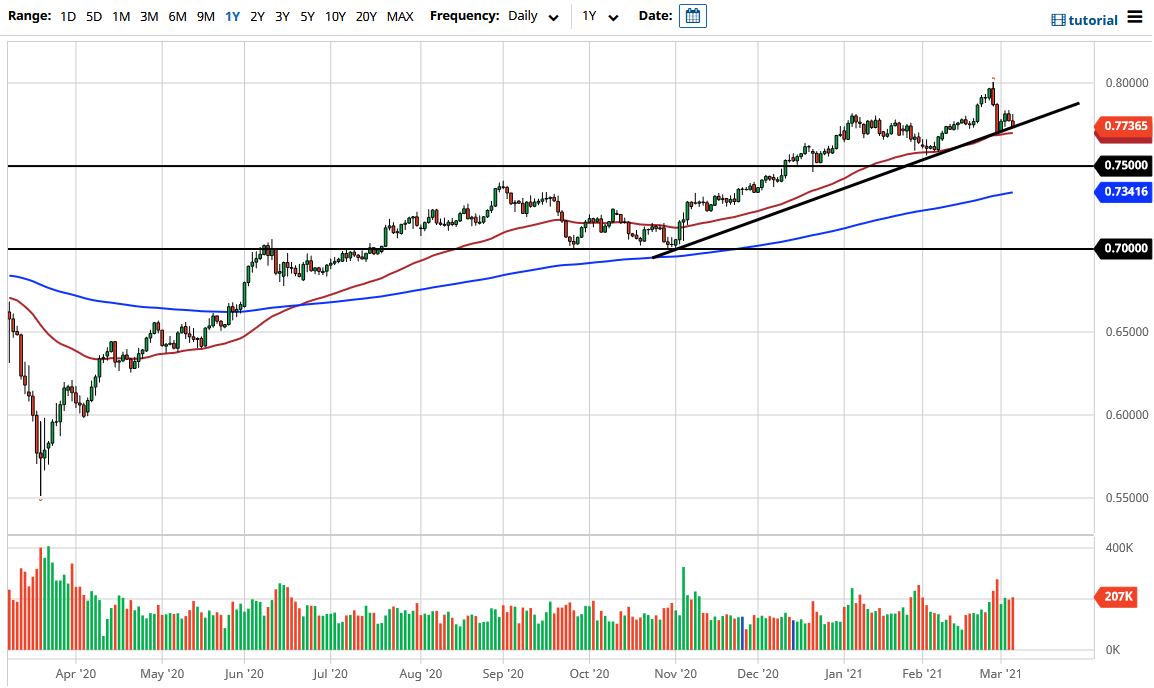

The Australian dollar initially tried to rally during the trading session on Thursday but gave back the gains as Jerome Powell failed to deliver soothing words to the bond market. That being the case, the market then sold off quite drastically to reach down towards the uptrend line and perhaps more importantly, the 50 day EMA. The 50 day EMA is often widely followed, and of course being next to the trend line adds more efficacy to the idea of support as well.

Even if we were to break down below that level, it is likely that the market would go looking towards the 0.75 handle. At that point I would anticipate that there would be a lot of buying pressure, and this could lead to a much more significant drop. I do think that breaking below the 0.75 level would be rather drastic, because it will have kicked off a sell signal based upon the monthly chart. The 0.80 level above is crucial from a longer-term standpoint, extending all the way to the 0.81 handle.

On the other hand, if we were to turn around a break above the highs of the last couple of days, then it is likely that the market goes looking towards the 0.80 level. The Friday session of course features the jobs figure in America, so we could very well get a catalyst based upon that. With all that being said, we are still very much in an uptrend, but we may need to kill a little bit of time in order to be comfortable trying to make the breakout above that level.

The Australian dollar of course is very sensitive to the commodity markets in general, so pay close attention to copper and iron, because if they do get a bit of a bid, that could send money back into Australia, as Australia is such a huge supplier of this to commodities. Furthermore, you have to pay attention to China and whether or not it is booming as per usual, or if it is struggling. Australia is a major contributor to the raw material stockpiles in China, so I think that is something that people should pay close attention to as well. We are still very much in an uptrend but obviously pressing the issue at the moment.