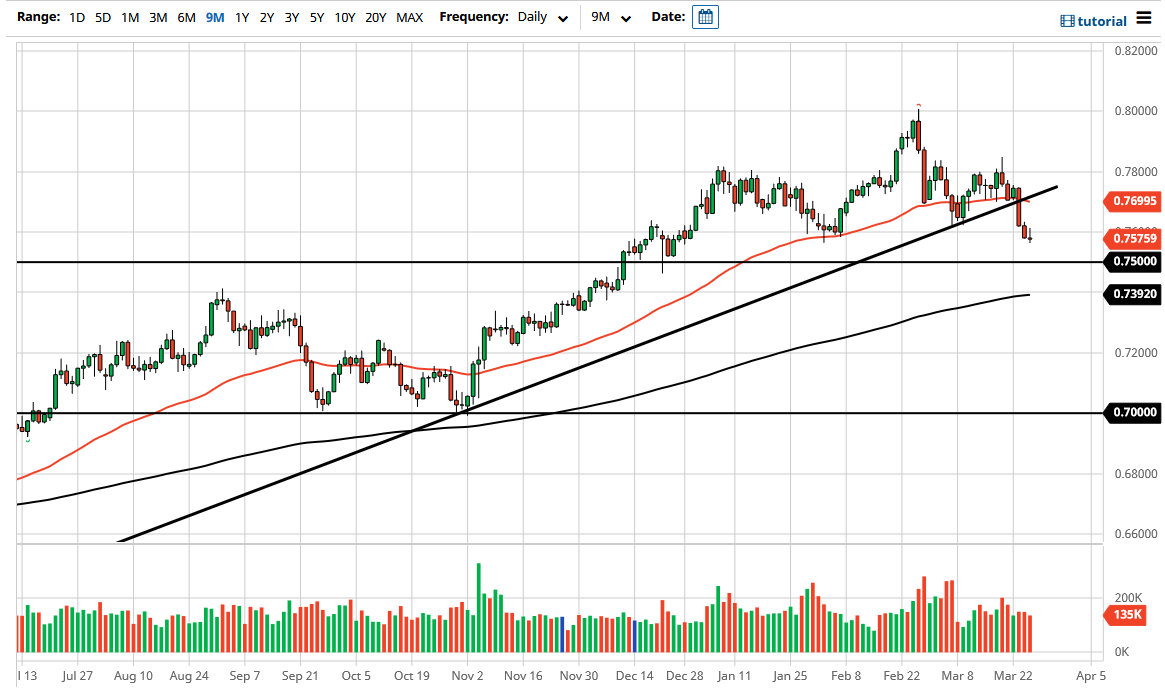

The Australian dollar has rallied somewhat during the trading session on Thursday to run into resistance near the 0.76 handle. At this point, the market then sold off a bit to form a less than impressive candlestick. In fact, this looks a lot like a market that is ready to continue going lower, kicking off the candlestick that made up a shooting star from the month of February. In other words, we could be looking at the beginning of something rather big.

For what it is worth, this is a market that has also formed a major head and shoulders pattern, so if that kicks off, we could see a huge move to the downside measuring roughly 400 points. That gives me a target of 0.71, an area where we have seen significant action at previously.

Do not get me wrong, even though this is a significant move just waiting to happen, when you look at the longer-term chart, you can see that the pullback has been minor so far, and even if we reached all the way down to the 0.71 handle, it would still be just a typical pullback. Remember, we shot straight up in the air for several months in a row, so a pullback has been necessary for quite some time. Markets cannot go parabolic forever, so this makes quite a bit of sense that we would see a pullback.

One of the biggest culprits for a pullback in this market has a lot to do with the yields in America strengthening, so that of course also drives this pair down as the US dollar becomes much more attractive. With that being said, we also have to pay attention to the commodity markets, and as a result this also puts downward pressure on the Aussie as well, so all of this lines up for what should be a decent pullback.

To the upside, the 0.80 level is a massive resistance barrier that extended all the way to the 0.81 level, based upon the monthly charts, so if we were to break above there then it is likely that we would go much higher, perhaps as high as 0.88. Obviously, that is a longer-term call though, and we are nowhere near making it move right now based upon what I have seen of the last week or so.