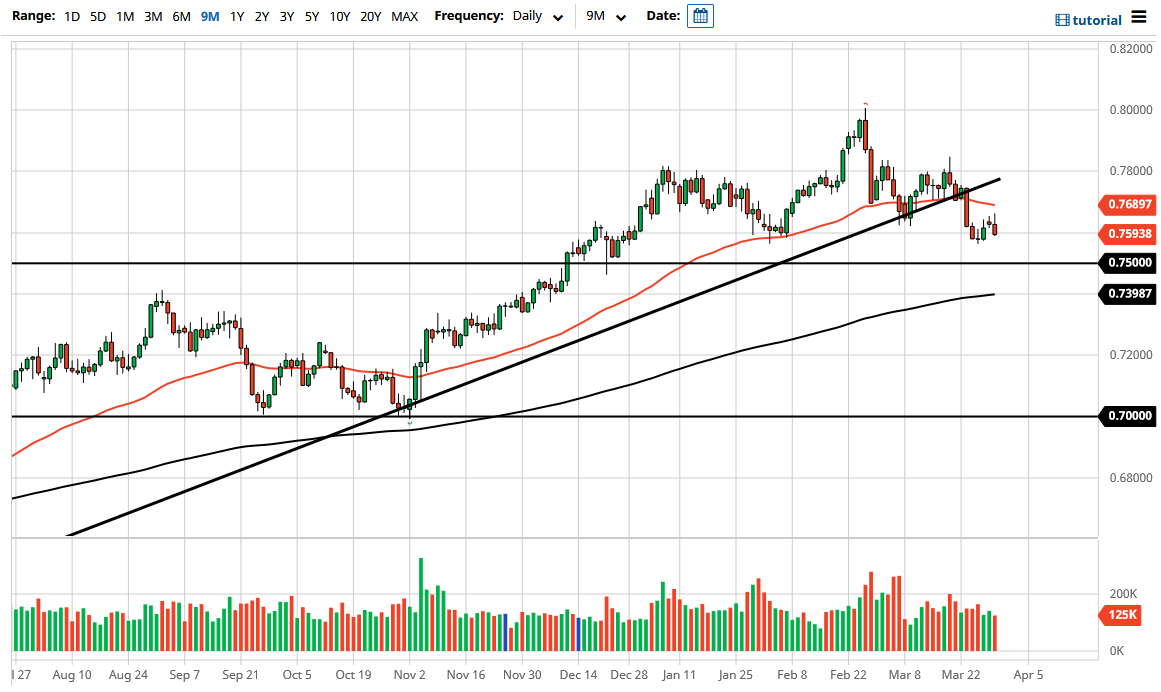

The Australian dollar has initially tried to rally during the trading session on Tuesday but gave back the gains to fall rather hard. Now that we have seen the action we have, the market looks likely to continue going lower. At this point in time, the 50 day EMA offers a significant amount of resistance above, as we have seen by the price action on Tuesday.

Furthermore, when you look at the longer-term chart, we have formed a massive shooting star for the month of February and it certainly looks as if we are getting dangerously close to kicking off that selling. The uptrend line that I have marked on the daily chart obviously has been broken down below, so that was your first serious warning. Now that the 50 day EMA is starting to tilt lower, it suggests that we are more than likely going to continue to see sellers, with the 0.75 level being the initial target. After that, then based upon the potential head and shoulders pattern that I see on the chart, we could go down to the 0.71 handle.

One of the main culprits of this move of course will be the fact that the interest rates in America continue to climb, as the 10 year Note has reached 1.76% during the trading session. As long as those yields continue to climb, it makes the US dollar much more attractive. At this point, it looks like those yields are going to continue to climb over the next several weeks if not months, so kicking off a move lower is what I would anticipate.

If we were to turn around and recapture the 50 day EMA to the upside, it could be an opportunity to send this market higher, albeit for the short term. Australia also has major issues as the Chinese and Australians are starting to bicker back and forth when it comes to potential trade war issues, and beyond that we also have to worry about the global growth situation deteriorating, which of course weighs upon the Aussie dollar as it is highly sensitive to the commodity markets. At this point, this is all about the US dollar and very little to do with anything else but at the end of the day it looks like we have further to go to the downside