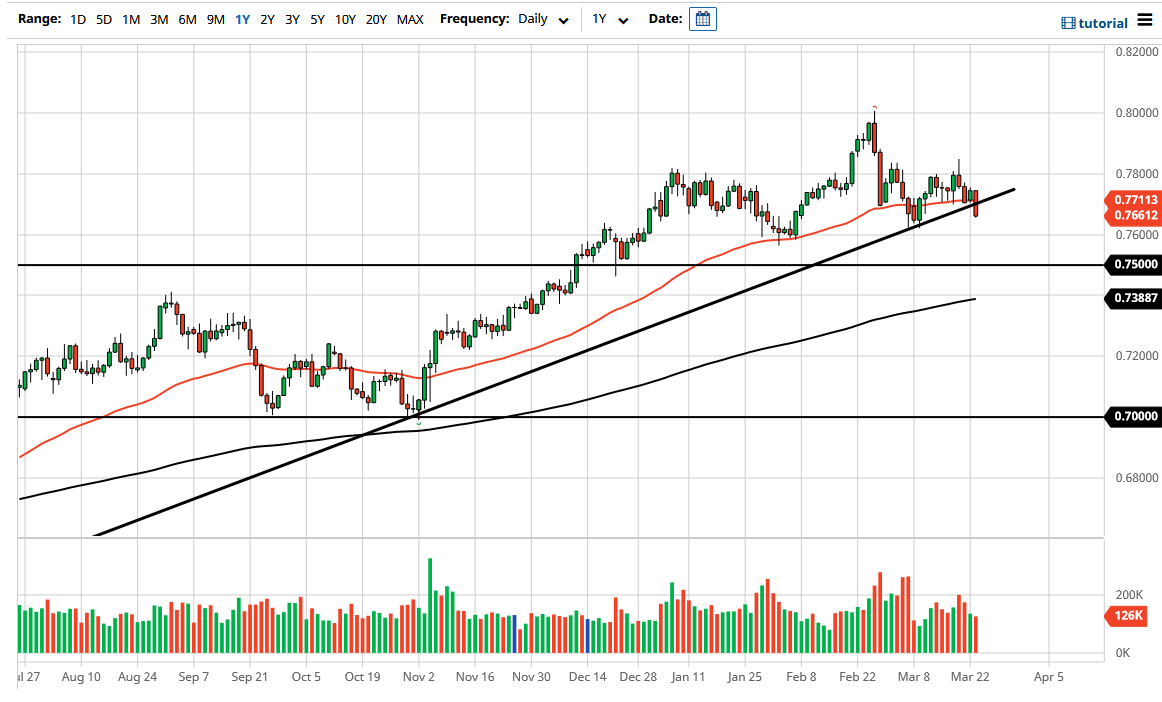

The Australian dollar has broken a major trendline that goes back well over six months in order to show signs of negativity again. As the Aussie falls, it is getting close to kicking off a “lower low” and looks like it may be ready to break down below the shooting star that formed for the month of February. That of course would be a very negative sign, and as we have seen the US dollar strengthen overall, it would not be a huge surprise.

We are closing towards the bottom of the candlestick and that of course is a very negative sign, so I do think that at this point in time we are likely to see further downward momentum. The 0.76 level should be supportive, and of course there will be support below there at the 0.75 level as well. If and when we break down below that level, that is where the plunge really starts to build up massive momentum. At that juncture, I suspect that the market is probably going to go looking towards the 0.72 handle, maybe even the 0.71 level.

On the other hand, if we turn around a wipe out the candlestick from the Tuesday session, that could send the Aussie back towards the 0.78 level, where we have seen a lot of resistance over the last couple of weeks. Clearing that area opens up the possibility of a move towards the 0.80 level above, which is a major barrier from a longer-term standpoint that runs all the way to the 0.81 handle above there. Breaking above that level would open up a longer-term “buy-and-hold” type of situation, but I do not think we are anywhere near that situation right now, so it is just something to keep in the back of your mind.

At this point, it is likely that we will see this market as one that simply trying to hang on to bullishness, and that even if we did show strength, it is probably going to be somewhat muted. On the other hand, if we do break down it could be much quicker so I would suggest that perhaps the risk for a bigger move probably lies to the downside, at least in the short term. Pay close attention to the commodity markets as well because they always have something to say about the Aussie.