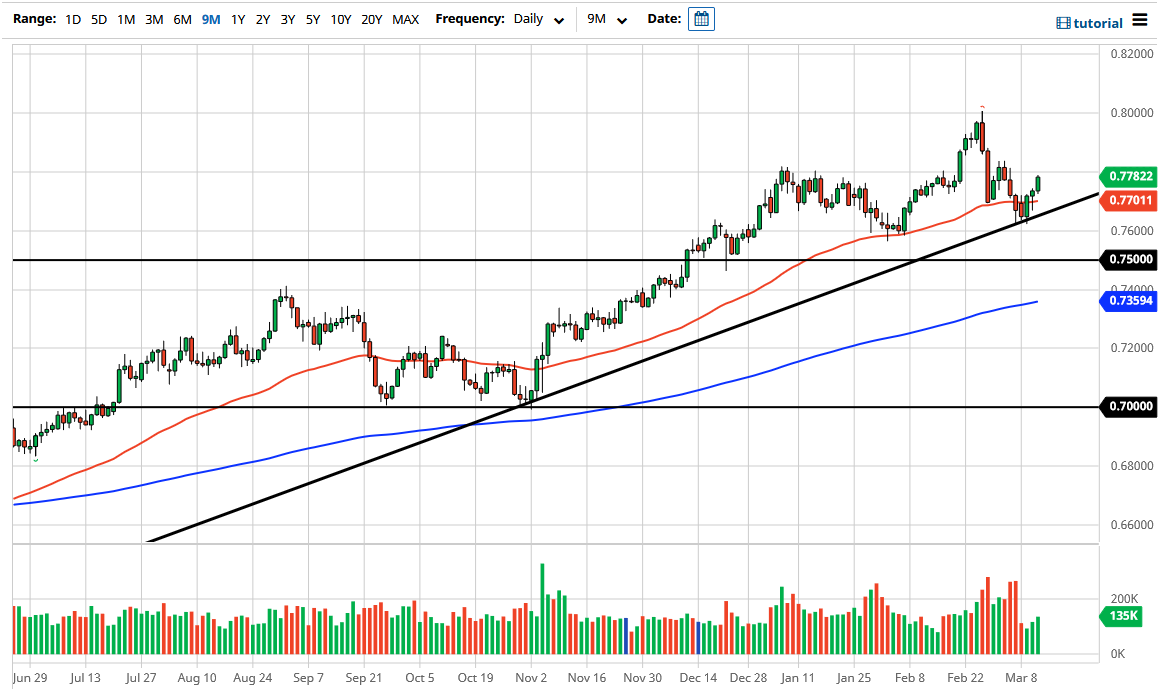

The Australian dollar has rallied significantly during the course of the trading session on Thursday to reach towards the 0.78 handle. The 0.78 level is an area that does offer a certain amount of resistance, as it was the place where we sold off from recently. That being said, if we can break above there then the Australian dollar is very likely to continue to go much higher, perhaps reaching towards the 0.80 level. The 0.80 level is an area that extends all the way to the 0.81 handle as far as resistance is concerned.

At this point, if we can break above the 0.81 level then it is likely that we will go much higher. In fact, that opens up the possibility of a move all the way to the 0.88 handle, if not the 0.90 level. In general, if we were to break out to the upside, this will become a “buy-and-hold” type of proposition. A lot of this is going to come down to the yields in America, which have been all over the place as of late.

For what it is worth, the market will also be paying close attention to the stimulus bill that was just passed in the United States that totaled $1.9 trillion. Beyond that, now there is talk of a potential infrastructure bill, and that could also drive up the demand for commodities in what has already been a very bullish market. Because of this, we could see the Australian dollar become the “darling of the Forex market” yet again. We have had a decent pullback, but the 50 day EMA looks as if it is going to offer support, just as the previous uptrend line seems to have.

The hammer from the trading session on Wednesday was the first sign that perhaps the uptrend was ready to continue, but I do think that we have a certain amount of resistance above that we need to pay close attention to. If we can break above that 0.78 level, then I think that we will see a quick move to the 0.80 level. To the downside, if we were to break down below the uptrend line, then it is very possible that we could go down to the 0.76 level. Breaking down below that level would kick off the February shooting star, perhaps seen quite a bit of bearish pressure come into the market.