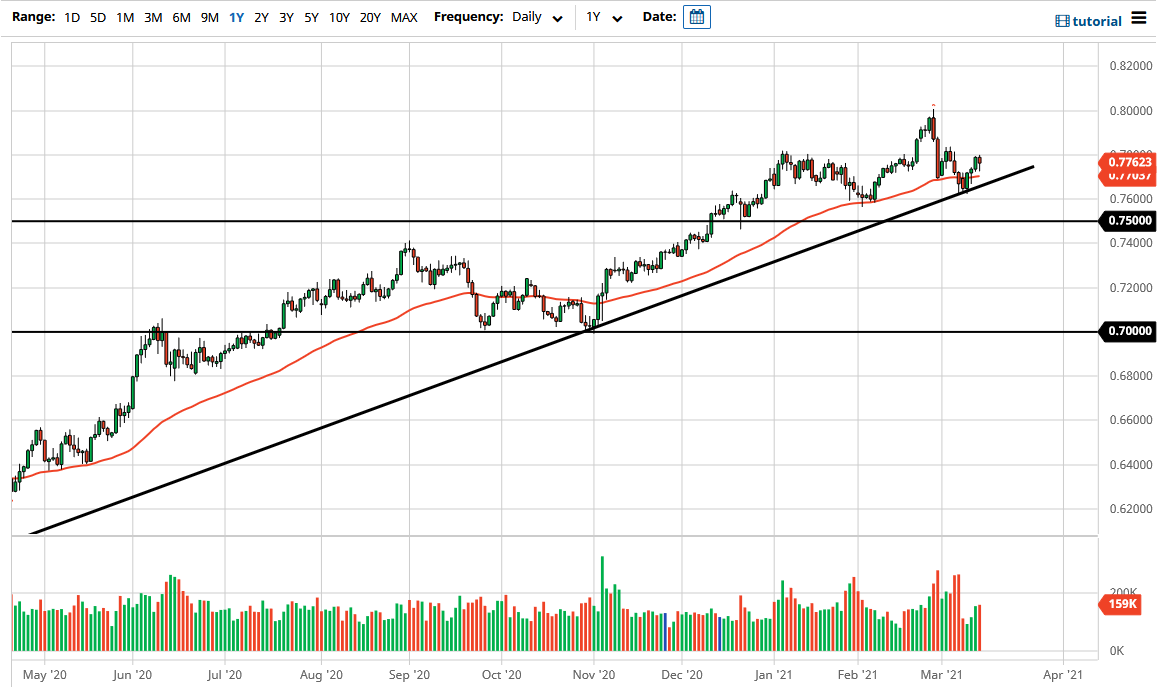

The Australian dollar has initially pulled back during the trading session on Friday but has turned around to show signs of life again. By forming the candlestick that we have, it shows that there are plenty of buyers underneath and we should continue to go to the upside. If we were to break above the 0.78 level, it would be another short-term barrier that we have overcome, and it could send the Aussie looking towards the 0.80 level. Keep in mind that this pair is highly sensitive to the commodity trade, so we need to see commodities rally to give it a little bit of a boost.

Underneath the current candlestick we have the 50 day EMA flattening out, so this could offer a little bit of dynamic support, and most certainly the uptrend line underneath will. The bounce from the uptrend line was rather impressive, and now it looks like we are trying to hang on to the channel that we have been in. Because of this, I do not have an interest in selling this market anytime soon, but there are some things to keep in the back of your mind if you are trading this pair.

For example, the February candlestick ended up being a shooting star, although it should also be noted that most of the selling was done in two short days. In other words, it will be interesting to see whether or not there is any follow-through, and I think that if we were to break down below the 0.75 handle, the Aussie could start to fall rather precipitously. I anticipate that if we were to see the market break down, it could be rather quick to happen. It would more than likely have a lot to do with the interest rates in the United States spiking again, or it could have something to do with concerns about global growth. All things being equal though, this has been a trade where traders have been focusing on the idea of high demand for commodities, as the world gives back to work after the pandemic. Whether or not that actually plays out could be up for interpretation, but right now that is the narrative that people are focusing on, so I do think that the market is going to go looking to the massive 0.80 barrier.